Nutrition industry's top deals of 2016

Nutrition Capital Network looks at notable mergers, acquisitions and equity financings in 2016 and what they tell us about trends in the nutrition and health and wellness industry.

February 14, 2017

Nutrition Capital Network, an organization that connects investors and strategic acquirers with companies in the nutrition and health and wellness industry, has released its top transaction lists for 2016.

"Top acquisitions reflect a diversity of trends like the potency of pills, the convenience of beverages, consumer interest in probiotics, and the value in the supply end of the industry," said NCN cofounder and CEO Grant Ferrier. "They also reflect growing strategic and investment interest in the nutrition and health and wellness industry by the food and beverage, ingredients and consumer products industries."

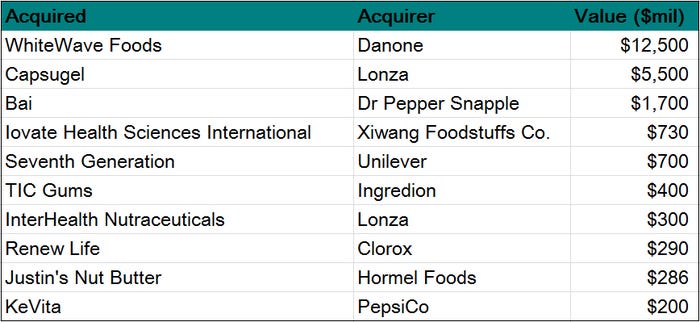

Nutrition Capital Network’s list of top 10 mergers and acquisitions in 2016 includes Unilever, PepsiCo, Clorox, Danone, Hormel and Dr Pepper Snapple among acquirers, in addition to global ingredient players based in Europe and China.

Top equity financings reveal the remarkable take-off in investments in biotech and agtech in 2016, as well as continued—although slowing—interest in foodtech and technology segments related to food and nutrition.

NCN Transaction Database tracks 13 percent more deals in 2016

The NCN Transaction Database recorded a 13 percent increase in transaction activity in the global nutrition and health and wellness industry in 2016 to 706 transactions, compared to 2015’s previous record number of 627 transactions. NCN measures transaction activity—captured globally in the NCN Transaction Database—in two categories: merger and acquisition (M&A) and equity financing (including private equity, venture capital, family/angel financing, etc., but excluding debt or non-cash strategic partnerships).

Nutrition Capital Network noted a continuing surge of investments in food and beverage companies in 2016, the primary focus of NCN’s annual New York and San Francisco investor meetings. NCN tracked 102 equity financings in branded food and beverage in 2016, on par with 103 in 2015 but far above the 26 average annual number of financing transactions in branded food and beverage (both natural and organic and functional foods) from 2010-2014.

Other trends highlighted in the NCN Transaction Database and Top 10 lists:

International activity continues to grow in traditional nutrition industry channels like supplements and natural and organic foods: Chinese companies acquired North American companies Iovate (MuscleTech and Hydroxycut sports nutrition brands) and supplement maker Doctor’s Best; Shanghai-based ClearVue Partners made a $30 million bet on CHIC Fresh, one of China’s leading juice companies; Coca-Cola acquired Latin America’s leading soy-based beverage brand; International Finance Corporation (IFC associated with World Bank) committed $40 million in equity and debt to Brazil's WOW Nutrition; and, like in 2015, several tech-enabled food ordering and delivery companies received 10-figure investments.

Beverages led the charge in food and beverage M&A, with Dr Pepper's $1.7 billion purchase of Bai and PepsiCo's $200 million acquisition of probiotic brand KeVita, a former NCN presenting company. In investments, home cold-press juicing system company Juicero raised $70 million; high-end sodas Q Drinks and Spindrift closed $11 million and $7 million equity investments, respectively; and kombucha, aloe and cleansing featured in investments in Health-Ade, LA Aloe and Daily Greens, highlighting functionality as a match with the convenience of beverages.

Plant-based alternatives and protein continued to attract interest as Danone spent $12.5 billion to buy WhiteWave Foods, owner of leading soymilk brand Silk and Horizon organic dairy; Justin's Nut Butter was acquired by Hormel Foods in a $286 million deal; General Mills’ 301 venturing arm invested $18 million in nut-based milk, cheese and yogurt company Kite Hill; and cricket protein company Exo (also a former NCN presenting company) raised $4 million in March 2016 and later received an investment from Japanese company Dentsu.

At least four more big food corporations launched dedicated venture arms in 2016 to make direct investments in innovative and disruptive companies too small to be acquisition targets. Notably, Campbell Soup, Kellogg, Hain-Celestial and Tyson Foods joined the growing pool of food and beverage multinationals with investment vehicles designed to provide capital and resources to nutrition industry entrepreneurs in return for exposure to new trends and growth opportunities.

Valuations for acquired companies continued to increase in 2016, with the average multiple of sales at more than 3.0 in branded food and beverage for the first time since NCN started tracking valuation ratios in 2006. NCN recorded no transaction in branded food and beverage in 2016 with a price/sales ratio of less than 2.0 after nine such deals were recorded in 2015. (Accurate data is not available for every transaction.)

Top 10 M&A transactions in nutrition and health and wellness in 2016

Source: Nutrition Capital Network Transaction Database

Top 10 financing transactions in 2016: Branded food and beverage

Source: Nutrition Capital Network Transaction Database

About the NCN Transaction Database: Nutrition Capital Network produces annual lists of top transactions in the nutrition and health and wellness industry, in addition to a summary of M&A and equity financing activity, derived from the NCN Transaction Database maintained since 2004. NCN lists are based on dollar value and strategic interest to the nutrition industry. The NCN Transaction Database tracks transactions in eight industry categories: branded food and beverage (natural/organic/functional), supplements, ingredients, contract manufacturing, OTC and personal care, retail and distribution, biotech and agtech, and technology (delivery, apps, e-commerce, etc.). The database is available to NCN’s 50+ Cornerstone Investor members.

You May Also Like