Grocery shopping has a hold on consumers, study finds

An FMI trends report points to ongoing strength of grocery shopping, even in the face of online growth.

June 27, 2018

“Grocery shopping remains the all-American pastime,” David Fikes declared with confidence in a Tuesday webinar on U.S. Grocery Shopper Trends 2018 from the Food Marketing Institute and The Hartman Group. Fikes, vice president, communications and consumer/community affairs at FMI, went on to say that “everyone feels they are a significant part of the household shopping action.”

Backing up that statement with data culled from the trends report, Fikes noted that grocery spending and shopping trips remain steady in 2018, with shoppers spending an average of $109 per week. That figure is consistent with the last few years, showing relative stability in overall levels of household food and grocery spending despite blurry lines between channels (including online), unexpected mergers and acquisitions, and new solutions such as meal kits.

According to the study, the average shopper reports that in addition to the 1.6 trips a week he or she makes to the grocery store, other household members take another 0.6, implying that the total number of trips per household each week is about 2.2.

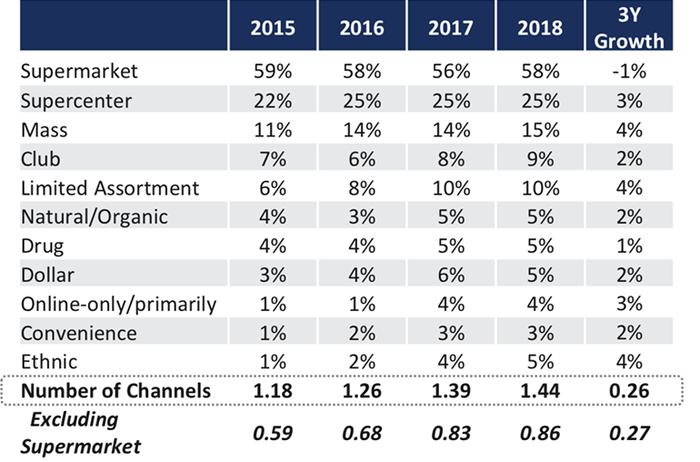

Channels used "almost every time" when shopping for food and groceries, historical trend

Source: FMI U.S. Grocery Shopping Trends, 2018

While online retail continues to grow, Fikes pointed out that “online shopping is not impeding visits to the store.” The number of shoppers who report using online grocery retailers at least sometimes has nearly doubled over the last three years, from 16 percent in 2015 to 28 percent in 2018, but “supermarkets remain the key grocery destination among all channels, hovering around 50 percent the past few years.”

“Traditional supermarkets are adapting—and adapting faster—to remain competitive,” said Fikes. “We see online-only retailers moving into brick and mortar, and the reverse also happening with supermarkets getting into online delivery and pickup.”

Center store and shelf-stable continues to dominate online commerce in grocery, and Fikes referred to the category as “gateway products to online shopping.”

Freshness counts

On the fresh side of things, David Feit, vice president, strategic insights, The Hartman Group, noted that food retailers are well positioned in health and wellness, as grocery stores have become increasingly important as an ally in eating healthy. Fifty-five percent of respondents said that their primary store was “on their side when it comes to helping them stay healthy,” compared to 45 percent a year ago. Overall, 41 percent said that food stores in general are “on their side,” compared to 33 percent a year ago.

“Fresh categories are the most important feature of the store,” said Feit, noting that in addition to high-quality produce and meat, customers are seeking out “careful curation of products that lead to meaningful store experiences,” such as an in-store cheese shop or olive bar.

The desire for engagement and experience has elevated the demand for transparency, according to the report. Shoppers desire a deeper level of information about ingredients, growers and production methods in order to better align their purchases with their values about sustainability and wellness. Consumers are looking for transparency on two fronts:

Curation of products from manufacturers and suppliers that are open, honest and specific about product attributes, quality and social and environmental impact; and

Communication and commitments by the retailer to provide additional information and context around product selection.

Feit added, “Trust in retailers to provide safe food is at a 10-year high, as consumers’ reliance on food stores has grown.”

Shoppers expect more from brick-and-mortar stores in terms of freshness, selection and price/value and more from online retail in the area of access to information, but overall they hold both brick and mortar and online retail to similar standards. But for all of the interest and value that online shopping provides, brick-and-mortar stores are still seen as delivering more strongly across all areas of shopper expectations, in particular freshness, price/value, personal engagement, returns and rewards programs. That said, online retail is becoming competitive, perceived to be doing at least as well as brick and mortar in terms of breadth of product selection, convenience, business practices, access to product information and discovery.

“Try to see how your store and your online business are working together,” suggested FMI’s Fikes, “and make that as seamless as possible. Look at all the avenues you’re using to convey information and engage with your customer, and engage more deeply with the issues that they are interested in.”

About the Author(s)

You May Also Like