Natural products industry prepares for a post-pandemic future

As food suppliers, distributors and retailers adjust to the COVID-19-related sales surge, they plan for an unknown 'new normal.'

May 2, 2020

As the nation continued to battle the COVID-19 pandemic in April—the month in which confirmed cases in the U.S. reached 1 million and disease-related deaths surpassed the 58,220 U.S. deaths during Vietnam War—the natural products industry found itself firmly on the front lines. In helping to keep food on America's table during an unprecedented time of turmoil, sadly, this came not without some illness and casualties of its own among workers in natural foods stores and in mainstream groceries.

The month also saw farmers dumping tons of eggs, milk and fresh produce—product that couldn't be re-routed—as restaurants, hotels, schools and other food service operations were shuttered. Frustratingly, grocers across the country were struggling to keep product on the shelf as supply chains were further strained. Food banks, too, experienced long lines and shortages of staple products, due in part to the demands of more than 30 million Americans' filing for unemployment between mid-March and April 23.

Yet, among a bunch of bad news, retailers, distributors, manufacturers and others in the natural foods industry continued to pivot and do everything they could to serve and protect customers, minimize risk to workers, ensure inventory and respond to ever-evolving local, state and federal guidelines and shelter-in-place rules.

First, in response to a worrying number of employee illnesses, many grocers are requiring all workers to wear face masks, which continue to be in short supply and high demand. In addition, the United Food and Commercial Workers International Union (UFCW) along with Kroger, Stop & Shop and others, issued a joint statement on April 27 calling on federal and state governments to designate grocery store employees as first responders or emergency personnel.

"We are urgently requesting our nation's state and federal leaders temporarily designate these workers as first responders or emergency personnel," the joint statement said. "This critical status would help ensure our essential grocery workers have priority access to testing, emergency childcare, and other protections to keep themselves and their families safe and healthy. For the sake of workers, their families, and our nation's food supply, this action will provide grocery workers with the vital protections they deserve."

Responding swiftly to the lack of personal protective equipment for natural foods employees, Presence Marketing worked with a brand partners to manufacture face masks and other protective gear for industry manufacturers, distributors and retailers, as well as a package for consumers, said Christine Tzumas, chief operations officer of Presence Marketing. "Our field team has been on the front lines from the beginning of this crisis, working fast and furious to serve our customers in any possible way, from helping unload trucks when they show up at the dock to lending a hand stocking store shelves," she said.

"The biggest thing for us right now is communication; we're communicating everything going on as quickly as possible," Tzumas continued. "Our brand partners have been receiving weekly, fact-driven COVID-19 updates, and the response has been so positive that we want to continue it in some fashion.

"While we've been dealing with this crisis, we still can't lose sight of what's on the other side and what the world will look like six months out from now. Hopefully, we will be moving beyond this," she added. "Our team has blown me away every day making sure to get food on the shelves. We're blessed to be with the people and companies we work with. You don't hear those same stories in other industries."

Phases of a crisis

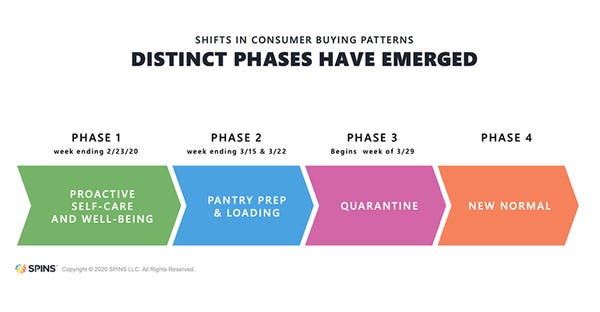

According to natural products market research firm SPINS, we've seen three distinct phases in terms of consumer shopping behavior since coronavirus crisis hit the U.S. in late February. With restaurants and other out-of-home dining options accountable for roughly half of all food expenditures, with their abrupt closure, demand doubled overnight for the nation's grocers.

By late February, consumers who had an early read on the coming pandemic were responsible for big upticks in sales of preventive care products in natural foods channels, including vitamins, dietary supplements, probiotics, and herbal and homeopathic products. SPINS refers to this as Phase one: Proactive self care and wellbeing, according to Kathryn Peters, executive vice president of business development for SPINS, in an April 21 webinar presented by New Hope Network.

"During the weeks of Feb. 16 and 23, when there was still just a small number of confirmed COVID cases in the U.S. and the problems in China still seemed a bit far away, there was an early band of proactive shoppers beginning to stock up in key immunity-related categories beyond the regular cold-and-flu season type of products. That was when self-care items also started to pop, such as hand wipes and sanitizer. By late February, people were beginning to have a hard time finding hand sanitizer in stores," she said.

When phase one began, "from just the previous week, we saw some extraordinary increases in a number of areas for the week ending Feb. 23," Peters said, noting a 1,285% increase in sales of vitamins and supplements and a 211% increase in herbal and homeopathic products.

"We all know what phase two looked like—during the weeks of March 15 and March 22—this was the mass stock up," Peters said. "During this 'Pantry Prep & Loading' phase, virtually everything sold." During this period, 15 million additional buyers bought natural products compared to the first phase, she said, adding, "That is a substantial number of products being bought by shoppers that are now in pantries. Time will tell if they will become continued shoppers; hopefully, there's been a lot of trial."

April was the start of Phase three: Quarantine, with upticks in sales of baking mixes, pastas and spa-related items as Americans hunkered down at home and did their best to cook for their families and pamper themselves while not being allowed to visit salons, massage therapists or other service providers. "Households seem to be bonding over baking, whether it's bread or desserts—Instagram is full of proud creations," Peters said.

"And then there's phase four, what life is going to look like on the other side," Peters said, noting there will be lasting shifts in consumer behavior once the health crisis subsides. With consumers homebound, re-connecting with cooking and seeking more prepared food options, grocers are being presented with an opportunity to capitalize on providing mealtime solutions, something they were having difficulty with before.

Organic produce, too, experienced a resurgence, recording a 22% sales jump in March and an 8% increase overall for the first quarter, outperforming conventional produce sales, according to the 2020 Q1 Organic Produce Performance Report published by the Organic Produce Network and Category Partners.

Growth could have been even higher, but widespread out-of-stock conditions tempered sales in mid-March. "Organic fresh produce sales in the first quarter were strong, and the impact of COVID-19 in March pushed numbers even more," Matt Seeley, CEO of the Organic Produce Network, said in a released statement. "We continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce."

"While comfort foods are important, we are seeing growing recognition of healthy and nutrient dense food, too. This comes with consumers' increasing recognition that our body's immune system is the best line of defense," Peters said. "Even with economic pressures, we see this continuing. We believe that this unfortunate health crisis will be a bright spot in continuing to bring health and wellness even more mainstream."

Consumers will continue to focus on proactive self-care and personal safety, purchasing high levels of immunity supplements, cleaners, wipes, masks and related household items, as well.

Supply shortages, prices and 'contactless' shopping concern retailers

"We are very concerned about those negatively economically impacted by the coronavirus crisis. If there's one major tectonic shift, it is the march toward more and better value product offerings to lower barriers of entry from a pricing standpoint," said Ben Nauman, director of purchasing for National Co+op Grocers. NCG's retail members reported that March sales were up nearly 30% compared to a year ago.

NCG has been helping its members coordinate distribution and supply chain issues, and take advantage of government stimulus programs. Now, it's reinvigorating a 2008 recession playbook to help members manage cash flow and liquidity during economic downturns.

"We're also beginning to explore what it looks like to retail in a more contactless way going forward," Nauman added.

For Sprouts Farmers Markets, a publicly traded natural foods retailer with nearly 350 stores and 30,000 employees, out-of-stocks have not been an issue. "Due to our brands and distributor partners, we are in good stock level considering how high our sales are, and our customers are recognizing how good we are about being in stock," said John Soukup, director of grocery for Sprouts.

The company recently expanded curbside pickup and Instacart delivery service to all its stores. "In addition, we have been very proactive in implementing measures to help our employees feel as safe as possible," Soukup said. Chainwide, all employees are required to wear masks and gloves; stores have installed sneeze shields in all checkout lanes; and store hours have been reduced to allow for deep cleaning.

Soukup also expressed concern about the manufacturing sector as the health crisis wears on. "We are starting to see SKU rationalization; vendors are having to prioritize what items they're going to make. That's going to ramp up over the next four to six weeks that could cause other out-of-stock issues," he said.

In times of crisis, "You understand who your partners are pretty quickly," Soukup said.

"We communicate daily with our distributors and just about weekly with our vendors. In this unprecedented time, our primary distributors, KeHE and UNFI, have done a phenomenal job," he said. "The broker community, too, including Presence Marketing, has done a great job for us in terms of serving as a liaison between the brands and what's going on in the stores."

Distributors see fundamental shift in demand

At UNFI, one of the nation's leading distributors of natural products, EVP of Supplier Services John Raiche has noticed some big changes. "The big difference between April and March is we've seen a fundamental shift in demand as students come home from college, people are staying home, and the food service expenditure is gone. The infrastructure was not designed to handle a sudden shift of that magnitude."

While retailers are no longer placing massive orders as they did earlier, on some evenings at the end of March, orders coming in equaled 400% of the distributor's capacity, Raiche said. UNFI, which has focused on worker safety and incentives, has hired more than 1,500 people since the beginning of March.

For Raiche, flexibility and communication are key right now. "We are trying to be as flexible and creative as possible with our suppliers on purchase orders, and we are trying to communicate with the industry and reach out to suppliers to share with them what we see, to offer to work with them, and to provide updates in terms of demand and opportunity," he said.

"For the team here internally, from receivers and collectors to drivers and the supply management team, there's a real sense of purpose," Raiche said. "People are open to working longer hours and doing whatever is needed. We're spending a tremendous amount of time thinking about what the future holds.

"When it started, many people were thinking it would be like a light switch. Everything I read is that any transition back to normalcy will take place over a good amount of time. For our manufacturers, this demand is not going to go back to the old normal anytime soon," he added.

At KeHE Distributors, "Our first priority is the safety of warehouse associates, professional drivers and in-store sales reps—the ones that are so important, the critical essential workers in this situation," said Scott Weber, EVP of merchandising. "Our second priority is servicing retailers and suppliers to try to keep up with unprecedented demand. We've developed partnerships with food service distributors to align all our capacity to meet the massive demand in our industry.

"The third priority is giving back. Through our KeHE Cares philanthropic program, we are supporting those most affected by the COVID crisis," he said.

While it may be a difficult time to introduce new products, Weber said that KeHE's category management and merchandising team "remains heavily focused on innovation because we know that when those retailers get back to new items and category reviews, we've got to have a robust line to offer." KeHE revamped its "Trend Finder" program into a virtual event to meet with new suppliers. "The most important thing right now is working with our suppliers to ensure we have the flow of inbound product to KeHE that enables us to serve our customers," he said.

Steven Hoffman is managing director of Compass Natural, providing brand marketing, PR, social media, and strategic business development services to natural, organic and sustainable products businesses. Contact [email protected]

Have some big ideas or thoughts to share related to the natural products industry? We’d love to hear and publish your opinions in the newhope.com IdeaXchange. Check out our submission guidelines.

About the Author(s)

You May Also Like