July 22, 2013

My favorite report for measuring category and item performance is the opportunity gap analysis. This report combines several others in one, including an item ranking comparison between both the account and the market, a cumulative dollar share report (also used to fuel the Pareto curve), and an opportunity gap analysis assessment by item/brand/category/segment, measuring item performance against the All Commodity Volume (ACV) benchmark for the account.

My favorite report for measuring category and item performance is the opportunity gap analysis. This report combines several others in one, including an item ranking comparison between both the account and the market, a cumulative dollar share report (also used to fuel the Pareto curve), and an opportunity gap analysis assessment by item/brand/category/segment, measuring item performance against the All Commodity Volume (ACV) benchmark for the account.

Key terms

Market: Your market is the geographic area that you sell in, including all of your competitors. The market is typically defined around a major U.S. city. For example Boulder, Colo. is in the Denver market. The more narrowly you define your market, the more efficient and accurate your opportunity gap analysis report will be. In the Denver example, the market is defined by the shape on the map that outlines the city of Denver, including all suburbs, cities and towns.

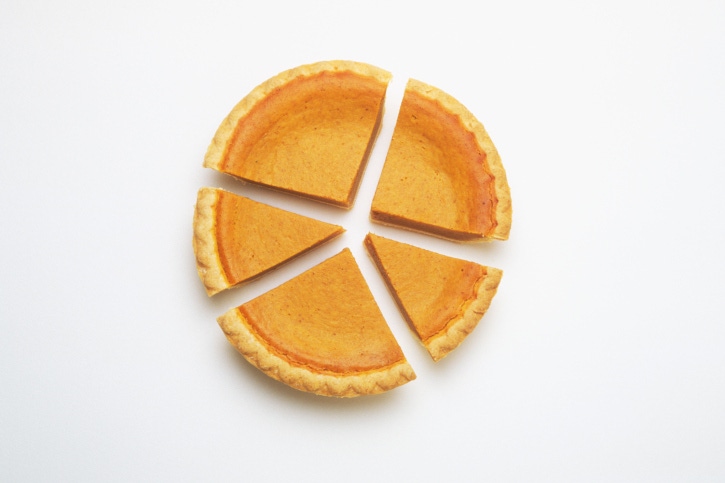

ACV: This is a retailer’s “fair share” of the total sales of every item sold by you and your competitors in your market (for example: all retail grocery stores in Denver). Think of the Denver market as a pie representing 100 percent of the total ACV. Each slice is a percentage of the different retailer’s total store sales: King Soopers, Natural Grocers, Whole Foods, Safeway, Sprouts, etc. A retailer’s “fair share” of sales (ACV) represents their share of sales in the Denver market. This number acts as a benchmark for comparing sales performance by retailer/category/segment/brand/item.

Both mainstream and natural stores should be included in the ACV comparison because consumers can purchase the same items and brands across each of the stores in the market: natural mac & cheese, soy milk, natural soup, organic bread, etc. While this level of comparison is difficult in the natural channel, there are ways around this. Contact me for details.

Item ACV is a weighted percentage of sales within the market at your store. This is dramatically different than the percent of stores selling measure that Whole Foods uses. For example, New Hope Granola is sold in 40 percent (4 in 10) of a retailer’s stores. This number does not quantify the size or the value of sales of those stores. Sales volume differs between each store in a retailer’s chain, and this calculation does not tell you if you are selling among the best or the lowest volume stores in the chain.

ACV, however, weights the sales for each store in the chain. A single store may represent 23 percent of the chain’s total sales volume. The four highest volume stores may represent 56 percent of the chain’s total sales volume. Selling New Hope Granola in those stores represents dramatically higher sales.

Opportunity gap: The sales gap between an item’s actual sales and the retailer’s fair share of sales in the market (ACV). In a perfect world, a retailer with a 33 percent ACV should capture exactly one third of all item sales in their market. If that retailer sells only 29 percent of the market's total New Hope Granola, they then have a 4 percent opportunity gap.

This can be translated into a dollar opportunity for the item and is important because it allows you to measure an item's/brand's/category's/segment's performance against your competition. The opportunity gap becomes the benchmark for sales performance across the entire store. It helps you set realistic and measurable sales and performance goals.

How do you measure your goals?

You May Also Like