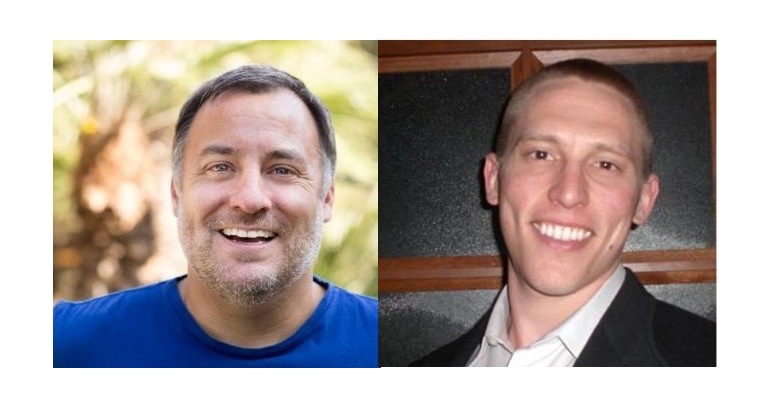

Douglas Raggio of Bias and Blind Spots and Michael Silverman of Samantha Brands Group discuss the venture capital cycles entrepreneurs must know and offer some predictions for future natural products industry investment.

“Increasingly in this space we’re seeing—and I think it is needed—more and more venture debt players.”

—Michael Silverman, Samantha Brands Group

Video highlights:

Venture will come in strong and recede. Will recession occur in the next three years?

Decisions Michael Silverman of Samantha Brands Group is making for five years down the road.

Venture debt explained.

This NCN Funding Forum session—Fireside Chat: Looking Ahead to the Next Century of Investment—was recorded at Natural Products Expo West 2019.

What's happening with NCN now:

Looking to invest in nutrition? Investors can still register for the NCN Spring Investor Meeting on April 23-24.

Want to pitch your brand? The deadline for NCN Europe VI at VitaFoods Europe is April 4.

About the Author(s)

You May Also Like