Twice each month our Nutrition Business Journal senior analyst provides insight on a new data point. Today's look, China's supplements market: complex and ripe with opportunity.

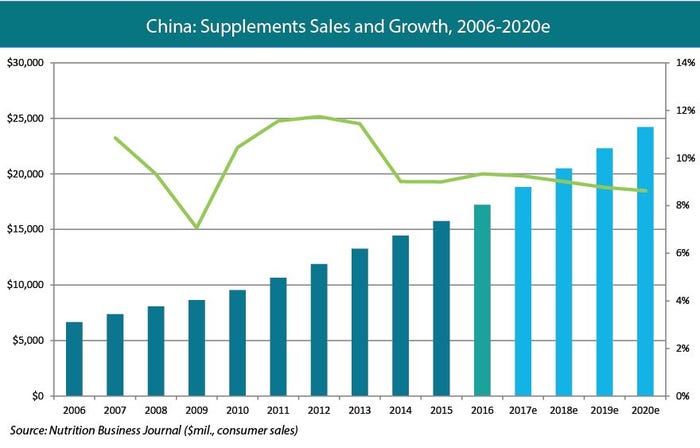

As Chinese consumers become increasingly focused on health, supplements sales growth is outpacing GDP growth in the country. The Chinese supplements industry reached $17.2 billion in 2016, with 9.3 percent annual growth, as compared to global supplements sales growth of 5.7 percent. The strongest growth comes from e-commerce in China, though direct selling through MLM/network marketing remains a driver of growth.

The strongest growth in China is in sports, meal, homeopathic and specialty supplements (compared to slower growth in vitamins, minerals, herbs and botanicals) largely driven by increasing consumer demand for quality sports nutrition products. Multiple supplements companies in China, including By-Health, launched products in the sports nutrition category in 2015 to 2017. Vitamins and minerals remains strong, driven by interest in prenatal and children’s supplements as Chinese parents prioritize child health. This focus on children’s supplements has also spilled over into condition-specific supplements in areas such as cognitive health and immunity.

See more in NBJ's 2017 Global Supplement Business Report

About the Author(s)

You May Also Like