This piece is part of the Good Food Insights series, a collaboration with FamilyFarmed and Esca Bona, which unpacks the dynamics driving the good food movement.

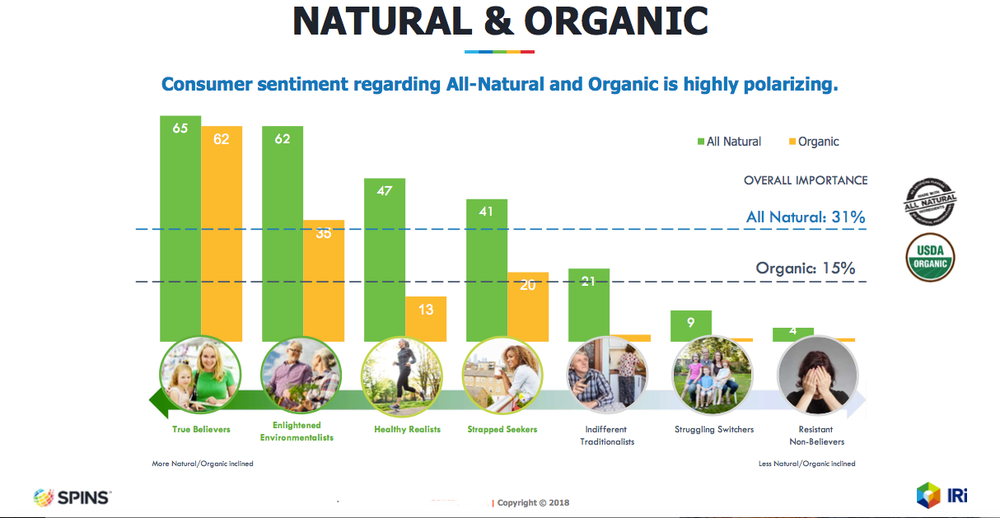

When it comes to good food, are you one of the True Believers or Enlightened Environmentalists who are really into it? A Healthy Realist or Strapped Seeker, who wants to eat better but faces budget and time constraints?

Or are products defined as natural and organic just not a priority for you, as an Indifferent Traditionalist, a Struggling Switcher or a Resistant Non-Believer?

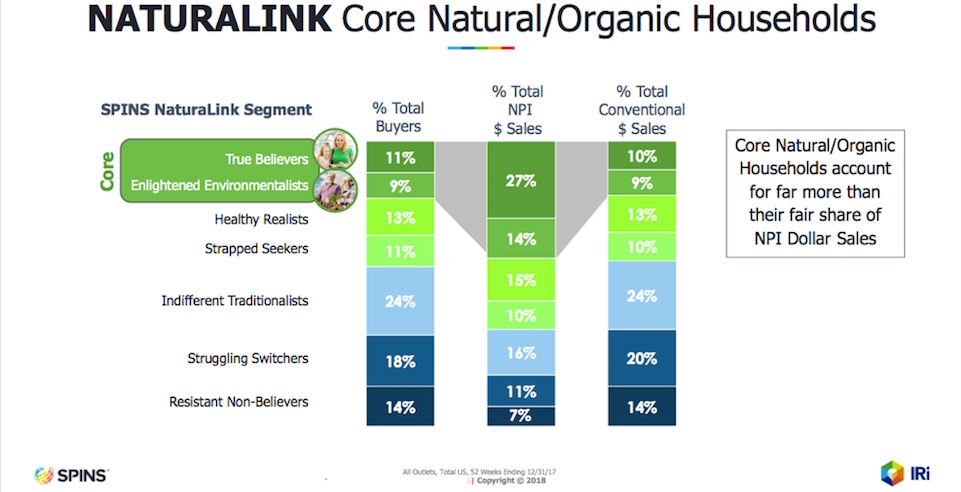

This segmentation is the result of the NaturaLink study, produced by SPINS—the leading provider of retail consumer insights, analytics reporting and consulting services for the natural, organic and specialty products industry—and IRi, which uses big data and opinion research to provide insights and predictive analysis across the business spectrum. NaturaLink segmentation divides the U.S. population into seven distinct segments based on their affinity, attitudes and purchase behavior toward natural and organic products.

Related: What does 'good food' mean?

Since you are reading this article, published by New Hope Network and written by FamilyFarmed, then there’s a good chance you are either a True Believer or an Enlightened Environmentalist.

If so, you are a member of the core constituency for natural and organic that makes up 20 percent of U.S. households, according to NaturaLink research. Natural and organic products (not just food, but also personal and home care items) are such priorities for these consumers that their market clout is nearly double its population share: A fifth of all households, the core buyers, are responsible for slightly more than two-fifths of natural and organic sales.

True Believers are 11 percent of households, according to NaturaLink. “We think of these households as the early adopters,” said Patrick Knight, SPINS’ director of consumer insights and the company’s project lead for NaturaLink. He works with SPINS’ brand, retail and investor clients to learn more about their existing and potential consumers. “We advise a lot of our clients about the trends or attributes that True Believer households are into. That’s a potential way of seeing what’s coming down the pike.”

Knight says the research provides some support for the perception that younger consumers are major drivers behind the quickening rise of the good food movement… but only to a point. He noted that the primary age range for True Believers is 25 to 44. But he notes that the average age of Enlightened Environmentalists is 55: “They are the Baby Boomers, and they want to use products that are good for the planet and healthy for you.”

While these core groups are the engines for the rapid growth in good food, Knight said there is great potential for future sales in the middle groups: Healthy Realists and Strapped Seekers. Consumers in both of these aspirational groups report an elevated interest in more natural and organic products, but face obstacles.

Healthy Realists (13 percent of households) tend to be college-educated families for whom convenience is a major issue, and they say their biggest hindrance is not enough availability of natural/organic options at their local store. “They are going to Kroger and buying their products. They’re not going to make the extra trip to go to a Whole Foods,” Knight said, “and they are more likely to start buying good food for their kids before they buy it for themselves.”

As the label Strapped Seekers suggests, expense is a big issue for this other aspirational group (11 percent of households). The first grouping that is not primarily college grads, Strapped Seekers have a median income of $45,000—less than half that of the True Believers.

So what about those lower-participation groupings, who make up more than half of all households: Indifferent Traditionalists (24 percent), Struggling Switchers (19 percent) and Resistant Non-Believers (14 percent)? There is data in the NaturaLink study that might give good food advocates hope for new converts: It found that 92 percent of all households have purchased products that have at least 70 percent organic content.

But Knight notes that there are big differences between these groups and the others, not only in volume of natural and organic purchases, but in their intentionality.

“There’s an organic item, maybe it’s on sale at a Walmart,” Knight said. “It’s good that there’s more accessibility for the product. But is it someone who really cares that much and is going to keep coming back and repeating?”

FamilyFarmed is proud to partner with New Hope Network on this series of articles that will unpack the dynamics driving good food. In coming months this series will feature portraits of the national good food landscape and individual industry sectors, and we will continue to back those insights up with facts provided through our partnership with SPINS.

About the Author(s)

You May Also Like