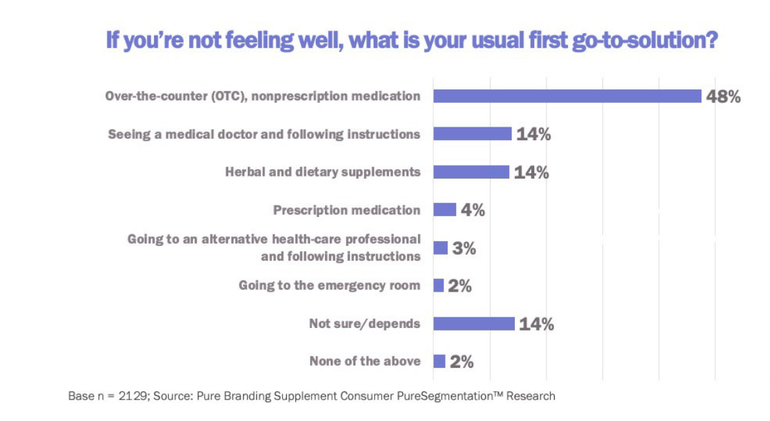

A survey by Pure Branding found that only 14% of supplement users reach for supplements as a first "go-to solution" when they are sick, and that a much larger percentage turn to over-the-counter drugs.

The pandemic gifted the supplement industy with a year of historic growth. Immunity supplements skyrocketed by 51% as millions of consumers moved beyond vitamin C and zinc to discover elderberry, mushrooms and other immunity boosters. However, all of that momentum for immunity may not translate to sales once the sniffles start and the immune system is overcome by infection.

In new consumer research from Pure Branding, it turns out that only 14% of supplement users make supplements their first choice when they get sick.

Pure Branding Market Research Director Peter Littell says the survey suggests supplement makers have an opportunity to nudge existing customers towards supplements for acute care. The Dietary Supplement Health and Education Act may prevent supplement brands from claiming to cure, mitigate or prevent disease, but the fact that a subset of supplement users do turn to supplements suggests more could be convinced. “If it has been done before, it can be done again,” Littel says.

Pure Branding surveyed 2,129 consumers who are already using supplements. The largest percentage, 48%, said their first “go-to-solution” was over the counter drugs. The 14% who said supplements were their first go-to-solution was equal with the number who said “seeing a medical doctor and following his or her instruction,” but it was also even with “not sure/depends.”

Littell said the results are a good illustration of how supplement users see the basic value proposition for supplements. Supplements are regarded as products that preserve health and can prevent problems down the road, but not as a solution for health problems that have already arrived. The results are also an illustration of the tunnel-vision focus of the supplement industry. Just because something works doesn’t mean consumers, even consumers who are already buying supplements, are going to reach for it when they feel sick.

“People in the supplement industry think only of what’s in the world of supplements, and they don’t think outside that world,” Littell says.

There are indications in the results, however, that could offer hope for supplement brands.

A subset of consumers in the survey is twice as likely as the whole of those surveyed to reach for supplements when they feel sick. The next step for brands is to study this “very loyal and dedicated supplement user” and see what prompts them to choose supplements as their first go-to solution, Littell says. Often that choice is driven by frustation or a bad experience with conventional medicine, but there could be other factors at work. Consumers who have bought into the prevention value proposition but haven’t rejected conventional medicine to the same degree might be nudged to consider supplements in acute care terms.

“Find what key things are driving those people,” Littell says.

About the Author(s)

You May Also Like