GNC can move forward in seeking creditors' approval of reorganization in case sale falls through, judge decides.

By the end of September, the world should know if Harbin Pharmaceutical Group Holding Co. Ltd. will be the new owner of GNC Holdings Inc.

Bankruptcy Judge Karen Owens ruled Wednesday that the stalking horse agreement between the two companies is satisfactory. Harbin agreed to bid $760 million plus the assumption of certain liabilities to establish a minimum purchase price for GNC's assets.

Harbin Pharmaceutical Group Holding Co. Ltd. is an affiliate of Harbin Pharmaceutical Group, a Chinese company that in 2018 formed a partnership with GNC Holdings Inc. and become its biggest shareholder. Harbin invested $300 million in GNC in exchange for the right to make, market and sell GNC-branded products in China.

If Harbin is outbid during the upcoming auction, it will receive $15.2 million in termination fees and up to $3 million for out-of-pocket expenses connected to making its bid, arranging financing and reaching the stalking horse agreement. Without those protections, Harbin would not have been willing to submit a stalking horse bid, the court noted.

"The stalking horse bidder has provided a material benefit to the debtors [GNC Holdings Inc. and its affiliates] and their creditors by providing a baseline value, increasing the likelihood of competitive bidding at the auction, and facilitating participation of other bidders in the sale process, thereby increasing the likelihood that the value of the assets will be maximized through the debtors’ sale process," Owens wrote in her order.

The deadline for other companies to submit a bid is still Sept. 11, and the auction will still be on Sept. 15. GNC and Harbin have agreed, though, to extend the closing date to Oct. 31 if Harbin is the highest bidder. The closing deadline was Oct. 15.

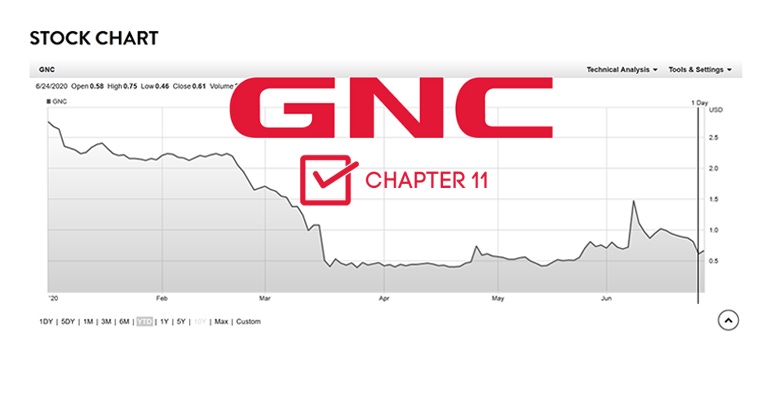

When GNC filed for Chapter 11 protection on June 23, it said it would either sell the company or reorganize it. GNC faced debt of $895 million, including $159.1 million of unsecured debt.

While moving forward with its auction plans, GNC also established a reorganization plan that Owens approved on Wednesday. It will begin mailing copies of the plan and related paperwork to certain classes of claims holders; they will have until Oct. 5 to file their objections. In that package of paperwork, GNC will urge the claims holders to approve the plan and lay out the consequences of the plan being rejected:

GNC could try to create a different reorganization plan.

GNC could file for Chapter 7 and its assets would be liquidated.

The court could dismiss the Chapter 11 case and claims holders would have to take independent action, such as lawsuits, to recover their losses.

The company cautions the claims holders that rejection of the plan could harm its future operations. "Termination of the restructuring support agreement could result in protracted Chapter 11 cases, which could significantly and detrimentally impact the debtors’ relationships with vendors, suppliers, employees, and major customers," the filing states.

About the Author(s)

You May Also Like