The original tight schedule would have deterred other companies from making offers to purchase GNC, objecting stakeholders argued.

GNC Holdings Inc. has revised the calendar for accepting bids and, if needed, putting the company up for auction in its Chapter 11 reorganization proceedings.

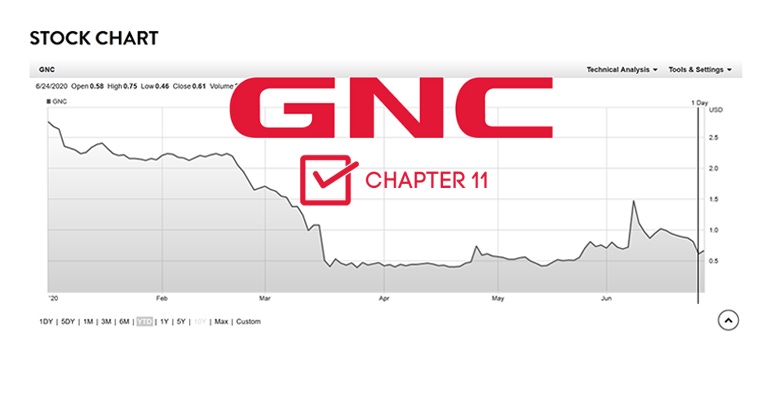

The company filed for Chapter 11 protection on June 23, with the goal of selling the company or reorganizing it by the fall.

The company has not yet reached an agreement with Harbin Pharmaceutical Group Holding Co. Ltd., an affiliate of GNC's largest shareholder, for Harbin to be the stalking horse bidder. Harbin has offered $760 million to purchase GNC; if the two companies reach a stalking horse agreement, $760 million becomes the minimum amount that any other parties can bid.

"We remain committed to working to finalize the Harbin stalking horse bid, in that it has the possibility to create additional value for the GNC stakeholders. We will continue to work in good faith with Harbin and our constituents on a transaction," Caroline Reckler, an attorney representing GNC, told the court during a hearing Wednesday.

Landlords, unsecured creditors and other stakeholders objected to the plan, largely because it didn't give other interested parties time to complete due diligence and put together offers for the company.

To resolve those objections, GNC has agreed to extend the bidding deadline at least one week. If a stalking horse agreement is reached by Aug. 3, the bidding deadline will be Sept. 4. If not, the bidding deadline will be Sept. 11. The auction is scheduled for Sept. 8 if GNC has a stalking horse agreement or Sept. 15 if it doesn't.

The group of 78 landlords involved in the agreement represents 646 locations, Reckler said.

Judge Karen Owens agreed to the proposal and on Wednesday signed the order to make it official.

The bidding procedure, which includes the calendar, was the only matter discussed Wednesday, as GNC and its stakeholders resolved 35 other issues before the hearing, and Owens had already signed the corresponding orders.

The termination of leases for 523 GNC retail locations in the United States—see a list, sorted by state and city—was among those orders. The dates of going-out-of-business sales and store closings vary, however.

Even before GNC filed for protection in the bankruptcy court, it had planned to close as many as 1,200 stores. Because of the COVID-19 pandemic, about 1,600 stores were either closed or operating with limited hours at the end of March, the company reported.

At the next hearing on Aug. 19, the court will review GNC's restructuring plan and objections to it.

About the Author(s)

You May Also Like