General Mills laid out a plan to grow its natural and organic business by two thirds in five years. Some of that will come from acquisitions like Annie’s, but all of it has meaning for the way America eats.

There is big money in looking small.

We have been talking about the “big is bad” consumer perception in the natural channel for years. We’ve also been talking about how the big companies are trying to look small by acquiring small brands. So we weren’t surprised Tuesday when General Mills laid out a roadmap that takes small brands into big numbers in a giant company with huge aspirations in organic.

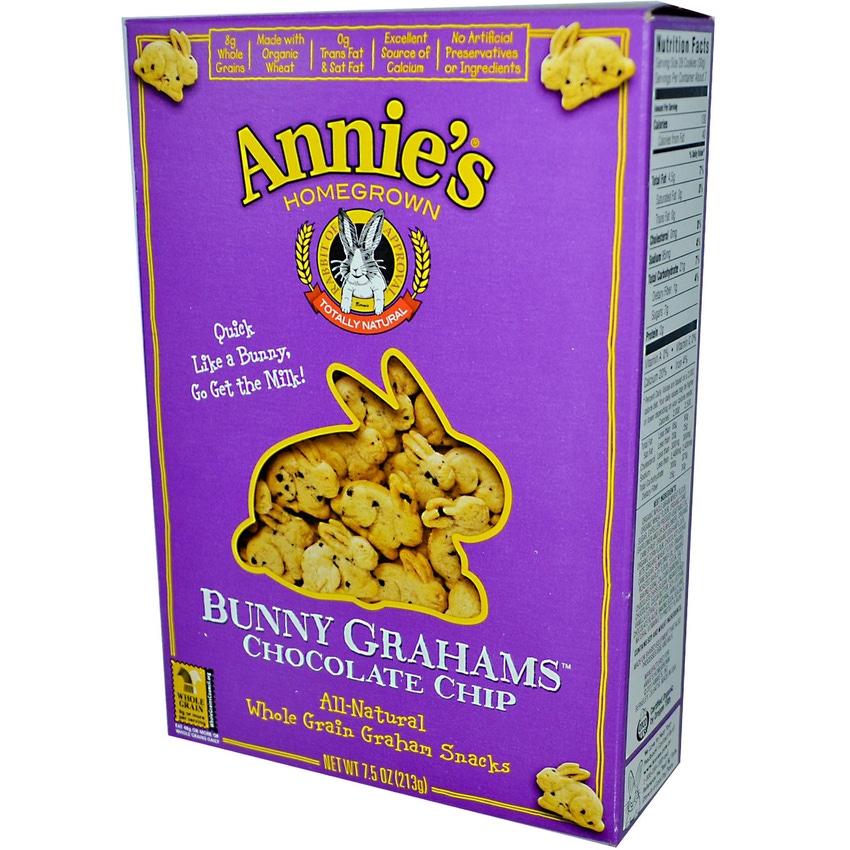

At an analysts conference reported in AdAge, General Mills CEO Ken Powell explained how the mega-corporation plans to grow the $600 million in annual natural and  organic product sales into $1 billion by 2020. Part of getting there means keeping brands like Annie’s looking like Annie’s always looked and ensuring that acquisitions like Larabar stay true to the natural positioning that made them attractive buys. They have shown some ability to do this. General Mills bought Muir Glen in 2000, and the products retain enough natural cred to stay on the shelves at Whole Foods Market — not the kind of venue where the General Mills logo is a common sight.

organic product sales into $1 billion by 2020. Part of getting there means keeping brands like Annie’s looking like Annie’s always looked and ensuring that acquisitions like Larabar stay true to the natural positioning that made them attractive buys. They have shown some ability to do this. General Mills bought Muir Glen in 2000, and the products retain enough natural cred to stay on the shelves at Whole Foods Market — not the kind of venue where the General Mills logo is a common sight.

Outside of the natural channel, where General Mills does the other $17.3 billion of its net sales, cred won’t matter so much, but words like “less sugar” and “organic” might. When the company paid $820 million for Annie’s in September, a 37 percent premium over the stock price, NBJ looked past the “They’re selling out!” chorus to call it a positive moment for a healthier food system. The agenda General Mills lays out suggests that big can learn from the success of small. They are listening and acting across a broader spectrum. The sugar in Yoplait yogurt will drop by 25 percent. Five Cheerios varieties will be gluten free by summer. The marketing divisions will include a “natural and organic center of excellence” to coordinate brands.

When General Mills takes natural and organic and some of the smaller brands into mass, it takes healthier food to scale, a move that means more demand for natural and organic ingredients and, in the end, more healthy food for more people.

According to Powell, it also means bumping up sales by two-thirds in five years. While that sounds ambitious, it also sounds like the company has discovered the virtues in the values of the smaller brands, knows that those values are real equity, and can bring them to a bigger market.

About the Author(s)

You May Also Like