Decoding today’s natural shoppers—and their interest in non-GMO

The Non-GMO Project’s latest consumer survey reveals important insights. Find out how natural products brands and retailers can connect with shoppers.

December 6, 2023

Compared to just a few years ago, today’s natural products shoppers are typically younger, better educated, more empowered and even more eco-conscious. They are highly invested in certified-organic and Non-GMO Project Verified products and committed to brands working to create change in the world.

These are among the key findings from the Non-GMO Project’s latest survey of U.S. and Canadian shoppers, as presented in a November webinar.

This extensive market research, which the Project first conducted in 2019, examines how both conventional- and natural-channel consumers feel about climate change, nutrient density, soil health and a host of other issues in 2023—and whether their attitudes and preferences have shifted in recent years. The results reveal their awareness of and interest in various product attributes and third-party certifications, including non-GMO, organic, plant based, fair trade and regenerative.

The new dataset also paints a compelling picture of who natural products shoppers really are in 2023 and how Gen Z is reshaping the marketplace—intel that brands and retailers can leverage to better serve their target consumers. Here are the salient takeaways.

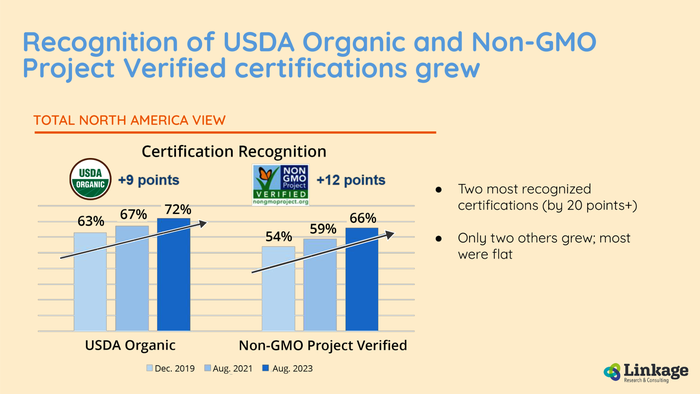

Consumer awareness of USDA Organic certification and the Non-GMO Project Verified seal has increased since 2019. All charts courtesy of Non-GMO Project.

Greater recognition and importance of organic and non-GMO

Among all consumers polled by the Non-GMO Project (conventional and natural shoppers combined), awareness and perceived importance of non-GMO and organic as product attributes remain strong. A whopping 88% are at least somewhat familiar with organic, a percentage that hasn’t budged since 2019. Meanwhile, 70% of consumers are aware of and somewhat familiar with non-GMO in 2023, up from 69% in 2019.

As for these attributes’ importance when deciding what food to buy, 31% of consumers say that organic is important, compared to 27% in 2019, while 30% deem non-GMO important, down slightly from 32% in 2019.

When it comes to actual third-party certifications, the survey shows that USDA Organic and Non-GMO Project Verified are the two most recognized seals by a long shot—and that consumer recognition has grown tremendously in just five years. With USDA Organic, 72% of shoppers now recognize the mark, a 9% increase from 2019. For Non-GMO Project Verified, 66% of consumers recognize the Butterfly seal, a 12% jump.

More importantly, today’s consumers are more interested in actually purchasing USDA Organic and Non-GMO Project Verified products than shoppers were five years ago. In fact, these two seals are twice as likely as any other third-party certifications to have a positive impact on purchasing.

In 2023, 47% of shoppers say that USDA Organic certification makes them more likely to buy a product, compared to 41% in 2019. As for Non-GMO Project Verified, 43% say the Butterfly makes them more apt to purchase, versus 36% five years back.

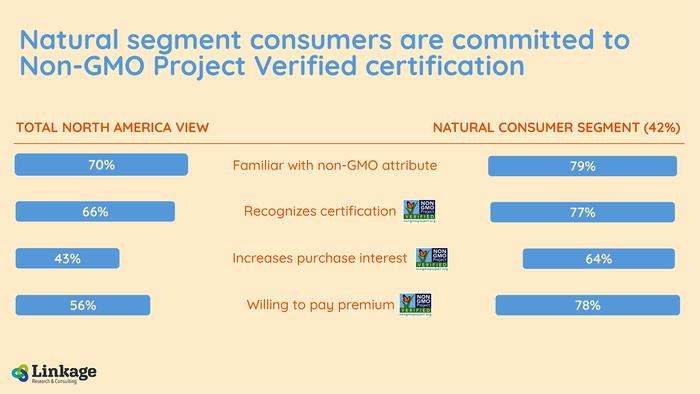

Consumers who shop in the natural channel are more likely to purchase or pay a premium for products that carry the Non-GMO Project Verified seal.

Natural shoppers decoded

Among the consumers surveyed, 42% are considered natural shoppers. But who exactly are natural shoppers in 2023?

Overall, this group is getting younger, with more than half belonging to the millennial and Gen Z demographics. And compared to their counterparts in 2019, today’s natural shoppers are more diverse in ethnicity and gender, make more money (but also carry more debt) and are more natural knowledgeable about product attributes and discerning in their purchases.

The research also confirms that natural consumers actively read labels, aiming to avoid artificial ingredients and looking for organic, unprocessed or minimally processed whole-food ingredients. They have strong opinions about GMOs, believing that natural foods are important and deeming GMOs unnatural. And overall, they believe that their food choices can help address climate change, environmental health and biodiversity and invest in brands creating positive changes in our food system.

Additionally, these folks are even more committed to Non-GMO Project Verified certification than the average shopper. For example, 77% of natural shoppers recognize the Butterfly seal, compared to 66% of general consumers, and 64% say it increases purchase intent, versus 43% of average shoppers. Additionally, 78% of natural shoppers will pay a premium for Non-GMO Project Verified products whereas just 56% of general shoppers will.

Natural shoppers also show an emerging interest in nutrient density. Eight in 10 agree that nutrient density is important, that organic and regenerative farming can improve it, and that soil health impacts nutrient density and therefore personal health. And while just 22% of consumers consider themselves very knowledgeable about nutrient density, the vast majority of natural shoppers are interested in learning more.

More on Gen Z: ‘The greenest shoppers yet’

The 2023 research reveals useful insights about Gen Z natural shoppers specifically. Most notably, along with caring deeply about health and wellness, Gen Z is more focused on the environment than any other generation, leading the Non-GMO Project to dub them “the greenest shoppers yet.”

Compared to other generations of natural consumers, Gen Z is most likely to be knowledgeable about climate change and believe that GMOs are bad for the environment, humans and animals, both in the immediate sense and long-term. Gen Z and millennials are the most likely to believe their food choices can help address climate change, environmental health and biodiversity and that industrial agriculture harms the planet and climate.

And while Gen Z seeks out the same attributes as all natural shoppers—minimally processed, whole-food ingredients, organic, non-GMO, etc.—they also have a much greater propensity toward climate-friendly and nutrient-density-related attributes. Additionally, this group is highly skeptical of marketing and on the lookout for greenwashing, so they have a higher level of trust in products certified by third parties.

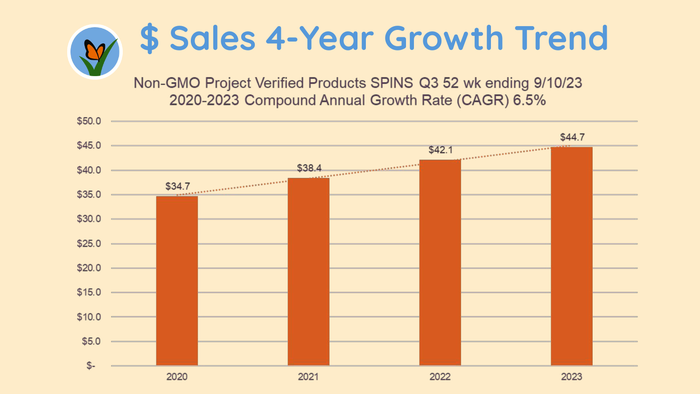

The market for Non-GMO Project Verified products reached $44.7 million in the 52 weeks ending Sept. 10, 2023, according to SPINS.

Are they buying the Butterfly?

Along with sharing the survey findings, the webinar also presented data demonstrating that heightened awareness of and interest in Non-GMO Project Verified products is indeed translating to purchases.

Currently, the Butterfly seal appears on roughly 120,000 SKUs, representing about 10% of the grocery marketplace—and sales of these products are increasing. According to SPINS, the market for Non-GMO Project Verified products reached $44.7 million in the 52 weeks ending Sept. 10. This is up from $34.7 million in 2020, representing 6.5% year-over-year growth.

During those same 52 weeks, Non-GMO Project Verified brands experienced double-digit sales growth in numerous categories. These include produce, animal- and plant-based yogurts, dairy and plant-based dairy alternatives, creams and creamers, and the shelf-stable categories of rice and grains, oils and vinegars, pasta and pizza sauces, condiments and dressings, and baking mixes and ingredients. Meanwhile, in a few health and body care categories, Non-GMO Project Verified brands saw triple-digit growth.

The Project also shared SPINS data indicating sales increases for other third-party sustainability certifications in the year preceding Sept. 10, 2023. For example, sales grew 5.7% for Certified B Corporation products, 7.3% for Certified Upcycled items and a whopping 18.5% for Certified Regenerative Organic SKUs.

Finally, it’s clear that carrying multiple third-party certifications boosts sales. Per SPINS, in the 104 weeks ending on Jan. 1, 2023, sales of USDA Organic products grew 7.5%, sales of Non-GMO Project Verified products increased 8.5% and sales of products bearing both certifications shot up 9.1%.

About the Author(s)

You May Also Like