Monitor: Consumers plan steady or increased supplement use post-vaccination

The supplement industry’s hope that higher supplements sales will last after the pandemic eases could become reality as consumers say they intend to keep up supplement use after being vaccinated.

Natural Products Industry Health Monitor, Jan. 15, 2020

A global lockdown might make weeks feel like months and months weigh like centuries, but business allows little room for ennui. As distracting as the daily inundation of the negative can be, the time to look forward is always now. In this feature, Informa Health and Nutrition sister properties provide that right-now-right-here update. Look for the Industry Health Monitor every other Friday to learn the major news that is affecting the natural products market immediately and the less obvious insights that could dictate where the market may struggle or thrive in the months to come.

Consider this: Boosted supplement use could persist after vaccinations

Though off to an uneven and even bungled rollout, COVID-19 vaccines are set to transform the pandemic picture for Americans in ways that are still hard to predict. What it means for the dietary supplement market and, perhaps the natural products industry in general, appears more clear in recent New Hope Network research.

New Hope Network surveyed 1,000 customers during the first week of January and found that only a tiny percentage of consumers intend to decrease their supplement usage once vaccinated. The percentage who said they would decrease supplement use moderately, a little or considerably was nominal, ranging from 0.1% to 2%. In fact, 63% of all shoppers claimed there would be no change with their dietary supplement routine once vaccinated. When compared to another New Hope Network survey conducted in May in which 40% of consumers said their supplement usage had increased in some capacity over the last month, increasing patterns are proving to be a boon for the supplement industry.

The results are clearly encouraging for natural retailers.

Among shoppers who plan to increase their consumption of supplements after receiving a vaccine, natural shoppers showed substantially greater intention. “Increase moderately” accounted for 19% of natural shoppers compared to 13% when looking at total shoppers. For respondents who said “increase considerably,” the numbers were 24% for natural shoppers and 14% for the total.

These results will likely be good news to dietary supplement makers who have been hoping for a “new normal” of increased supplement use after the pandemic subsides. The intention of consumers to continue or increase supplement consumption after being vaccinated is the clearest sign that a healthy new normal could be realized.

All of this fits well with results on current usage. A large majority of natural shoppers, 70%, indicated they have increased their consumption of supplements, with 48% describing the increase as moderate or considerable. Among all shoppers, 54% said they had increased their consumption. This marks an acceleration in interest since May when a New Hope Network survey found 40% of consumers predicted their consumption of supplements would increase over the next six months.

A deeper dive into the results will be featured in the Jan. 28 issue of Nutrition Business Journal.

The deep interest in immunity support is also reflected in a report on American consumers from Spoon Guru, a UK-based AI-driven analysis startup. The report suggests an unflagging interest in healthy eating to build immunity, but the most important finding in the report for natural retailers may be where they turn for information.

A notable number of respondents, 40%, indicate they expect their grocer to provide information on healthy eating, while 67% want the government to educate consumers about healthy eating to support immunity. The report does not break consumers down into conventional and natural shoppers, but the results suggest there could be an advantage for natural retailers, a channel famous for the educational component in its relationship with shoppers.

The same report illustrates how vital that education could be. Only half of Americans are eating fruits and vegetables to support their immune health, and only 24% have given up on sugary foods. Though it’s a small number, 13% say they are eating more indulgent foods to relax.

Know this: Interest in better products is steady for consumers and investors

The natural products industry investment index measures dramatic shifts in investment activity as we march through COVID-19, compared with a 2019 “normal” benchmark before COVID-19 emerged. Nutrition Capital Network monitors monthly financial activity in the natural products industry.

Consumer behavior indexes measure dramatic shifts in consumer behaviors as we march through COVID-19, compared with a 2017 “normal” benchmark before COVID-19 emerged. These indexes are assessed through monthly surveys of how consumers perceive their shopping behaviors.

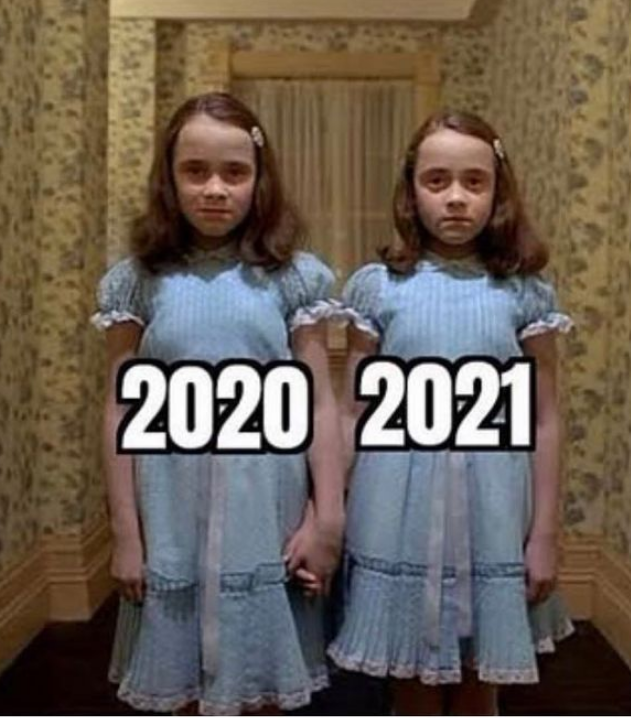

Enjoy this: Early disappointments

We all had high hopes for 2021. Is it too soon to be looking forward to 2022?

About the Author(s)

You May Also Like