April 11, 2023

New Hope Network's Nutrition Business Journal, an Informa Markets brand, has released its first-ever mid-year market update to revise previous projections given the economic climate through the second half of 2022.

NBJ previously released estimates in June 2022, forecasting growth at 4.2% for 2022 and falling to 3.7% in 2023. After research and analysis completed in January, NBJ now estimates growth at 1.7% in 2022, falling to 1.2% this year before an expected recovery in 2024.

This updated research is covered in NBJ's Special Report: Supplement Market Economy Update 2023, which is available for purchase. Research in the report includes not only updated market sizing forecasts but also results from industry and consumer surveys conducted late last year. These insights are included in the new report:

Coming off the record growth in 2020, NBJ had projected a normalization in 2022, but the reality of the year was a further slowdown than anyone had previously anticipated. NBJ's revised estimated growth of 1.7% in 2022 brings sales to a total of about $1.5 billion lower than previously thought. Even with this slowdown, NBJ expects sales will be back on track with pre-COVID projections by 2024 and pulling back ahead by 2025.

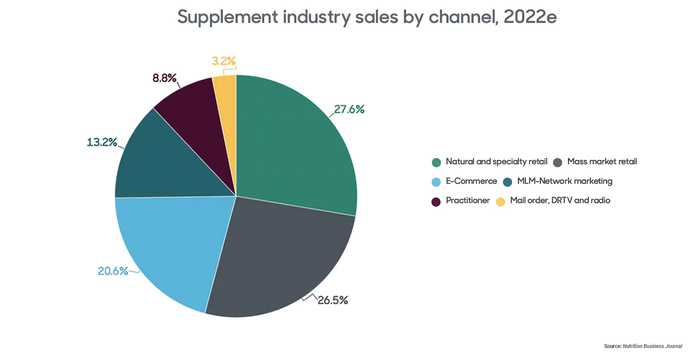

One of the most surprising drops in growth last year came in e-commerce, which dropped to an estimated 3.9% growth coming off years of double-digits. An additional surprise was an uptick in mass market retail growth, the only channel where NBJ increased growth estimates, to 6.7%, given a shift in consumer preference toward store brands and value brands.

In a survey of U.S. consumers repeated in July, September and November of 2022, NBJ found that consumers are definitely feeling the impacts of inflation. In November, 63% of consumers reported feeling pressure or stress due to inflation and rising costs, up from the previous two survey periods. Even more importantly, 61% of consumers have reported changing their grocery shopping behaviors as a result. Vitamins and minerals fare slightly better than other shopping categories, with 17% of consumers reporting buying more in November than the same time last year.

"Being the predictor for an industry is never an easy undertaking, but the events in 2020 and beyond have made it both easier and harder. In such unprecedented times, there is complete understanding in revising previous projections, though the news comes a lot easier when the projection comes in the form of record sales growth of 14.5%, rather than an adjustment in the opposite direction," says Claire Morton, NBJ senior manager of Data and Insights.

NBJ Director of Content Bill Giebler says, "GDP is strong and unemployment is low, but inflation is real and supplement supplies are overstocked from ingredient suppliers all the way down to consumer cabinets. It's not just about recession and it's a confusing picture for the supplement industry—especially after pandemic-driven sales boom of the past three years."

Industry professionals can tune in for an in-depth discussion with the NBJ team about the report and what's to come in an exclusive Economic State of the Industry three-part video series. For information on NBJ's company plans or corporate subscriptions, please reach out to [email protected].

Industry members can visit Nutrition Business Journal online and follow on LinkedIn to join in on ongoing conversations.

You May Also Like