October 11, 2021

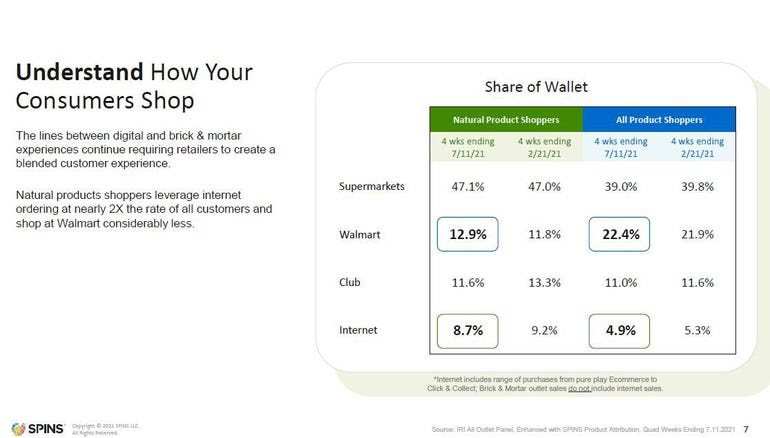

Immunity and wellness are still top of mind as consumers continue to search for clean ingredients, but there are many other factors driving growth when it comes to organic products.

During the Organic at Retail: Trends and Insights session held at Natural Products Expo East 2021 in Philadelphia, industry experts discussed the organic trends retailers need to watch.

The organic industry, both food and non-food categories, increased at a rate of 12.4% in 2020 for $61.9 billion in sales. That’s a drastic increase from a 5% growth rate in 2019.

“Organic has really expanded beyond food and beverage into vitamin supplements,” said Scott Dicker marketing data analyst at SPINS. “It goes into alcohol, body care and all other categories as well.”

Top trends for 2021 include being plant-based, having clean labeling with minimal ingredients, sustainable meat and dairy, being immunity-focused and mission-based and offering options for a variety of lifestyles and diet preferences.

Look to Amazon for intel into organic trends, said Jake Bernstein director of sales at ClearCut Analytics.

“We believe trends happen on Amazon approximately 24 months ahead of food, drugs and mass,” Bernstein said. This is because Amazon has infinite shelf space with a range of products, and includes a mix of legacy and digitally native brands that may not be reflected in traditional brick-and-mortar data.

It also makes up a huge portion of CPG e-commerce with approximately 70% of online sales coming from Amazon, Bernstein said.

Emerging trends in organics

Consumers are proactively doing more self-care and want pantry preppers that require fewer retail trips as they optimize their time. Shrinking wallets mean there’s still higher home consumption of coffee, wine and beer for simple indulgences.

Organic shoppers continue to cook more homemade meals that involve meal prepping with nutritious ingredients, while “penny-pinched shoppers” stretch their dollars by purchasing private label, value-sized products such as beans and grains.

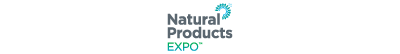

Natural products (up 5.9% in dollar growth) and organics (up 2.2% in dollar growth) are leading the dollar growth that is seen in the total industry growth, with conventional products seeing 1.9% dollar growth.

Alcohol, medicine and personal health, vitamins and supplements and produce departments are leading year-over-year growth for organic products.

In the food and beverage category, organic products labeled gluten-free, vegan and plant-based are still doing well. "Super mushrooms," a category that has seen an 11.2% year-over-year dollar growth, and superfoods, a category that has seen 5.7% year-over-year dollar growth in 52 weeks, are doing exceptionally well, Dicker said.

“So that transition from being a supplement into food and beverage as functional foods is quicker than ever,” Dicker said.

Retailers need a strong online presence

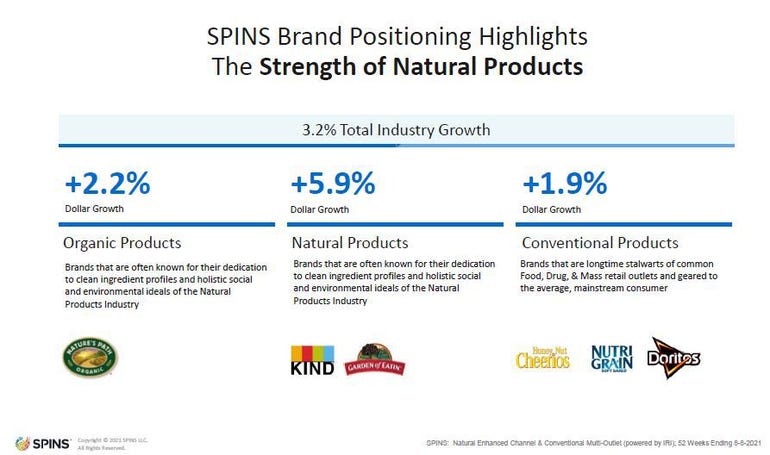

Natural products shoppers are purchasing more online at almost twice the rate of those purchasing all products, and are buying less from Walmart than those who are shopping for all products, said Jeff Crumpton, retail solutions manager at SPINS.

“Consumers are more likely to go into the store when conditions are safer, but when they’re not, they are turning to e-commerce,” Crumpton said.

Expect private label to bounce back

Organic private label brands did really well last year and then declined. “A lot of that could be because co-packers are prioritizing national brands over private labels,” Crumpton said.

Expect private label brands, which are core to retailers, to see improvement as supply chain issues begin to be worked out, Crumpton said.

Top food and beverage organic categories

Refrigerated milk remains the top category within food and beverage by dollar volume, with a slight year-over-year dip as consumers did pantry stocking last year, Crumpton said. The other top categories were refrigerated juices and functional beverages, bread and baked goods, refrigerated eggs and frozen entrees.

Items including organic shelf-stable creams and creamers are seeing 57.2% year-over-year growth and outperforming non-organics that are trending downward. Organic shelf-stable soda and carbonated beverages are seeing 57% year-over-year growth compared to the 6.8% in non-organics. Same for organic refrigerated tea and coffee which are seeing 41.1% year-over-year growth, compared to the 18.7% growth in non-organics.

There’s big growth in organic beer, hard cider and other malt beverages, which are seeing 81.7% year-over-year growth, compared to the 2% growth in non-organics.

Organic non-food and beverage items are also seeing growth

Performance nutrition used to be consumed by a gym-heavy, pre-workout, male-dominated sector, Dicker said. But that’s audience has expanded to all genders and age groups as consumers engage in more active lifestyles. Performance nutrition is seeing an 83.7% year-over-year growth, compared to the 28.2% growth in non-organics.

Key ingredients for supplements and vitamins

Organic superfood and whole-food supplements are seeing 81.8% year-over-year growth, Dicker said, which is way more than the 34.2% rate non-organics are seeing.

Gluten-free and non-GMO labels are still very important, Dicker said, as well as paleo and clean labels that are free from artificial ingredients. Vitamins and supplements that contain nootropics and superfoods are seeing strong growth. Apple cider vinegar as a functional ingredient saw a massive increase, with a 842.2% year-over-year dollar growth in 52 weeks.

“We saw 2020 being all about immune health,” Dicker said. “That’s shifted to overall wellbeing.”

That’s impacted adjacent categories such as mood support, which has seen a 65.3% year-over-year dollar growth in 52 weeks, as well as supplements that focus on sleep support, stress support and gut health performance.

“Consumers aren’t just looking for their functionality but they’re also looking for that natural edge with organic being a key go-to,” Dicker said.

Notable supplement subcategories

Organic multivitamins, protein power and turmeric should be watched as notable supplement subcategories.

“The organic growth rate for each of these subcategories is outpacing that of the subcategory overall, as well as for non-organic products,” Bernstein said.

Organic multivitamin category is seeing 63% year-over-year growth, compared to 43% non-organic growth rate. That’s led by brands like SmartyPants, Garden of Life, New Chapter, Rainbow Light and Naturelo.

With a $30.69 average price point for organic multivitamins, compared to $21.58 average price for non-organics, Berstein expects it to be more competitive in the future and continue to see organic have more of the market share.

Organic protein powder is seeing 52% year-over-year growth, compared to 32% non-organic growth rate, led by Orgain, Garden of Life, KOS, Vega and Sunwarrior. Organic turmeric is seeing 48% year-over-year growth, compared to the 28% non-organic growth rate. The top organic brands are Bio Schwartz, Gaia Herbs, Garden of Life, New Chapter and Doctor’s Best.

Unlike multivitamins, both subcategories are still seeing higher price point averages for non-organics than organic options.

Vitamins and supplements seeing growth

There’s been huge growth in vitamins and supplements labeled 95-99% organic. “There’s a huge opportunity,” Crumpton said. “A lot of brands are really leaning into this customer trend of purchasing vitamins and supplements in this category. It’s a trend to continue watching.”

Last year, vitamins and supplements labeled organic 70-90% suffered, but have made a comeback in the past six months, Crumpton said.

Protein supplements and meal replacements, which saw declining sales last year are “starting to open back up,” he said.

Organic superfood and whole food supplements are seeing 81.8% year-over-year growth, Dicker said, compared with the 34.2% rate non-organics are seeing.

The Natural Products Expo East 2021 session Organic at Retail: Trends and Insights is available for replay in the Natural Products Expo Virtual community platform.

About the Author(s)

You May Also Like