March 20, 2015

[Click to enlarge]

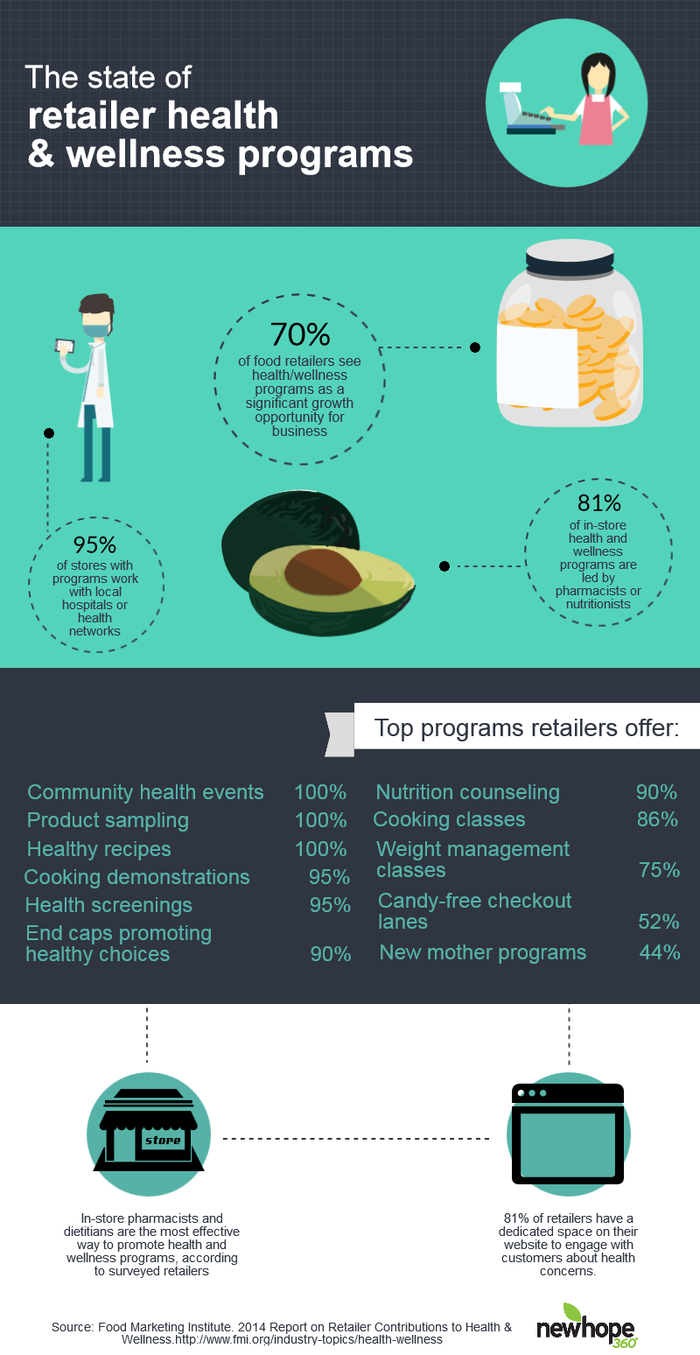

It's no surprise that supermarkets are providing an increasing array of health services, but a new report from the Food Marketing Institute takes a close look at the extent to which food retailers are becoming true healthcare destinations.

The strongest sign of this shift might be the rapid growth of supermarkets operating in-store clinics that offer key services like flu shots, health screenings and other vaccines. In 2013, 40 percent of retailers surveyed had in-store clinics in some or all stores; in 2014, that figure jumped to 70 percent, according to the report. (FMI represents members operating nearly 40,000 retail food stores and 25,000 pharmacies across the U.S.)

Supermarkets are also relying on in-store pharmacists and dietitians to connect with consumers on health issues. According to the report, 95 percent of stores employ dietitians at the corporate, regional and store levels, and while 90 percent of stores invest in advertising and social media outreach, most reported that the dietitians and pharmacists are their most effective tool for engaging customers on health and wellness. That's in part attributed to the active roles that dietitians and pharmacists are taking in stores: 67 percent reported that they are working together to develop programs, and 48 percent are working together to make customer-specific recommendations.

This also points to another crucial point from the report: Consumers rank pharmacists as their third-most trusted source for health information after doctors and nurses, which is good news for the food retailers employing them. The report notes, though, that consumers are also much more likely to trust retailers that have partnerships with local healthcare providers—local hospitals, allied health organizations, insurance providers and even local gyms. An impressive 95 percent of stores surveyed do have some such partnership, but consumers aren't always aware of these partnerships even when they do exist. So there's some potential there for retailers to take advantage of, if they can more strongly publicize these partnerships.

Building Interaction

More than half of stores said they offer cooking classes for customers with restricted diets as well as weight management classes for adults. Most stores are putting healthy recipes on their websites, and just over half are making them available in stores as well, on printed cards or in kiosks. Stores are also embracing and acting on the emerging research on the benefits of families eating together—84 percent said they actively promote communal eating, up from 75 percent in 2013. But few of these programs are formal, opening up potential opportunities for growth in this area as well.

Naturally, websites also offer opportunities for engagement. More than 80 percent of retailers surveyed have a space on their website dedicated to health and wellness, and 67 percent said they have a similar page for employees. The most common topics on these sites are common health concerns and food allergies, followed by local or in-store health programs, where consumers can find their pharmacy and information on drug interactions. The sites are also used to share health articles, healthy recipes and answer questions about nutrition.

Finally, supermarkets are recognizing the need to measure the effectiveness of their efforts in this area. Almost 90 percent of retailers reported that customer participation and attendance at program activities are the most effective tracking tools for these programs. Consumer comments were second, and only next—in third place—did sales rank in its effectiveness as a tracking tool. The report cautions against reading too much into sales alone: “While tracking sales is certainly a reasonable and common form to track all new initiatives, retailers are cautioned to remember that consumers need to have awareness of health and wellness programs, and have a positive attitude about them, before they will change their behavior as a result of participation.”

Ultimately, FMI shows there is plenty of potential for retail and healthcare to overlap even further, and to do so in a way that benefits both community needs and business bottom lines. “Insurers are actively looking for alternatives to reduce costs and satisfy consumer preferences. At the same time, the majority of consumers are interested in receiving minor care beyond the doctor’s office,” the report concludes. “We are seeing an unusual and ideal confluence of circumstances—healthcare environment, consumer interest, and supermarket-solution-provider capabilities—for food retailers to define the business models that will build the future of retail healthcare.”

About the Author(s)

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)