E-commerce to account for 20% of U.S. grocery market by 2026

Stores to fulfill 75% of online orders via pickup, Mercatus/Incisiv study forecasts.

October 25, 2021

Online grocery sales will surpass 20% of the overall U.S. grocery retail market in the next five years, at least several years before pre-pandemic projections, a new Mercatus/Incisiv study predicts.

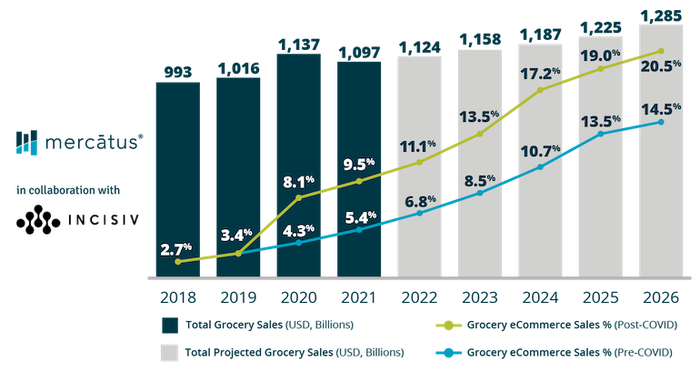

Grocery e-commerce sales are forecast to account for 9.5% of total U.S. grocery sales of $1.097 trillion this year, up from 8.1% of $1.137 trillion in 2020, according to online grocery specialist Mercatus’ “eGrocery Transformed: 2021 Market Projections and Insight” report, conducted by research firm Incisiv and released this week. From there, online’s share is projected to expand to 11.1% of $1.124 trillion in grocery sales in 2022 and to 20.5% of $1.285 trillion in 2026.

That’s well ahead of estimated growth for the online grocery market before the COVID-19 crisis. Pre-COVID, e-grocery sales were expected to reach 5.4% of the total market in 2021, up from 4.3% in 2020, and then climb to 6.8% in 2022 and to 14.5% in 2026, the study said. Current growth projections include a marginal reduction over 2020’s estimate, as U.S. consumers adjust to returning to brick-and-mortar grocery stores.

Related: As digital sales soar, profits are a concern for grocery retailers

“While shoppers indicated their eagerness to head back to stores, ingrained behavior and added convenience of online grocery will ensure omnichannel sales continue to grow at a stable pace, reaching 20% of the total grocery sales by 2026,” Mercatus said in the report.

Pandemic-related health and safety concerns remains a key driver of online grocery shopping. Of nearly 42,000 grocery customers in 20 states polled for the study, 43% shopped online in 2020, up 80% from 24% in 2018. Still, even with relaxed restrictions and store reopenings, online grocery adoption rose 14% to 49% of respondents in 2021.

Seventy-two percent of those surveyed cited convenience and 45% pointed to time savings as chief reasons for buying groceries online. Yet 28% said lingering health concerns about COVID have them using online grocery services, and 30% report their e-grocery use was pandemic-induced but are sticking with the service because it’s convenient.

Indeed, 46% of grocery shoppers polled said they bought more categories online in 2021, compared with 34% indicating they did so in 2020. That has come despite declines in online average order value (AOV) and trips from last year’s burst in consumer stockpiling during the early months of the pandemic. Online AOVs fell 14% from $106 in 2020 to $92 this year, largely from reduced bulk-buying in the first half of 2020, the Mercatus/Incisiv report said. Meanwhile, monthly online shopping trips dropped 12% from 2.6 to 2.3 as more grocery customers returned to in-store shopping this year.

Clearly, U.S. online grocery customers have gravitated toward click-and-collect over home delivery as their preferred fulfillment method, the study noted. Seventy-six percent of respondents said they favor in-store (44%) and curbside (31%) pickup, compared with 24% preferring delivery.

The number of online grocery customers who used curbside pickup at least once in the past year rose to 61% for 2021, up from 57% a year earlier, while home delivery adoption remained flat, according to the “eGrocery Transformed” report. At the same time, 46% of online grocery customers used delivery at least once in the last 12 months, the same as in 2020.

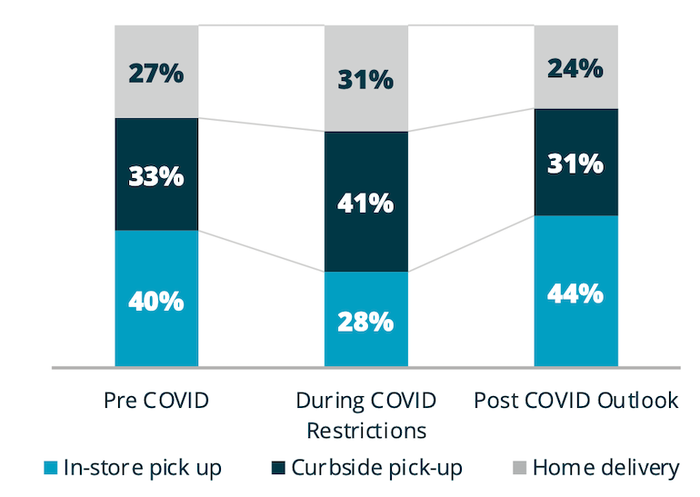

COVID-19 changed e-grocery fulfillment preferences, the study showed. Pre-pandemic, 27% of online grocery consumers preferred home delivery, compared with 33% favoring curbside pickup and 40% embracing in-store pickup. During the height of the pandemic, 31% opted for delivery versus 41% for curbside and 28% for in-store pickup. Now, 24% express a preference for home delivery, whereas 31% prefer curbside service and 44% like in-store pickup.

“Home delivery is expected to shrink to lower than pre-pandemic levels as customers shift their preference to pickup,” Mercatus stated in the report. “Three-quarters of all online orders are expected to be fulfilled via stores, either in-store pickup or curbside pickup. Among suburban households, delivery adoption is 80% lower as compared to urban shoppers.”

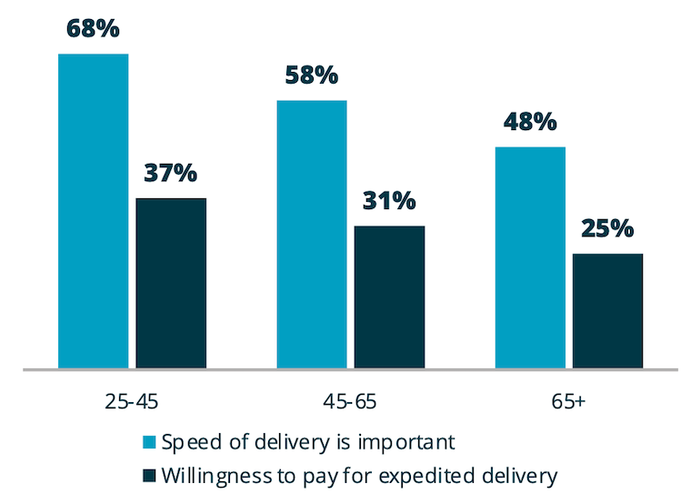

When asked about their online grocery fulfillment preferences, respondents cited higher fees and surcharges as the top reason for favoring pickup. Fifty-seven percent of online customers described expedited delivery (same-day) as important, but just 15% indicated they’re willing to pay a separate fee for it.

“Pickup works particularly well for both grocers and their customers in the North American market,” explained Sylvain Perrier, president and CEO at Toronto-based Mercatus. “Pickup services offer grocers more control over the cost to serve online customers than third-party delivery. Online customers love the precision, flexibility and overall convenience that store pickup provides. And when done well, pickup services make for a better overall shopping experience that builds lasting connections with customers, which will lead to repeat business for grocers.”

Other than their preferred supermarket, 56% of those surveyed named mass merchants like Walmart and Target as top options for online grocery shopping, compared with 33% citing online-only retailers like Amazon and 11% favoring delivery marketplaces like Instacart, the study said. Still, 34% cited Instacart as the delivery provider for their last grocery order, while 24% named their preferred supermarket’s delivery service, 22% cited Amazon/Amazon Fresh and 6% named Shipt.

“While consumers do not like the added cost and lack of control associated with third-party marketplaces, grocery retailers continue to drive customers into the hands of delivery providers,” the Mercatus/Incisiv report said.

Going forward, mobile will become a bigger e-grocery conduit, as consumers are expected to increase their mobile channel usage in the next year by 14%, the study revealed. Online grocery customers indicated they aim to shop via mobile devices (through apps and the web) at three times the rate as desktop over the next two years. Mercatus/Incisiv’s findings showed that, on mobile apps, customers view 4.2 times more products, spend six times more time and generate a three times higher conversion rate versus desktop interactions online.

About the Author(s)

You May Also Like