Fresh snacking makes the perimeter even more central to grocery store success

This piece is part of the the Good Food Insights series, a collaboration with FamilyFarmed and Esca Bona that unpacks the dynamics driving the good food movement.

“Fresh snacking” on products in the health and wellness channel is one of the hottest trends in food retailing. To understand the significance of that statement, we need to review how nearly all Americans snacked not very long ago.

For generations, supermarkets have followed a basic design. Around the store perimeter are fresh foods: meats, fish, produce and dairy. Dominating the center of the store are aisles and aisles of shelf-stable consumer packaged goods, including the full range of conventional snacks: cookies, candy, crackers, chips, pretzels and the like.

But today, the retail environment increasingly reflects rising consumer demand for healthier—and fresher—alternatives to all kinds of food. And as this sentiment intersects with the desire of busy consumers for portion-sized grab-and-go items, the store perimeter is increasingly where it’s at for health-conscious snackers.

Related: Every U.S. region seeing serious growth in natural food and beverage sales

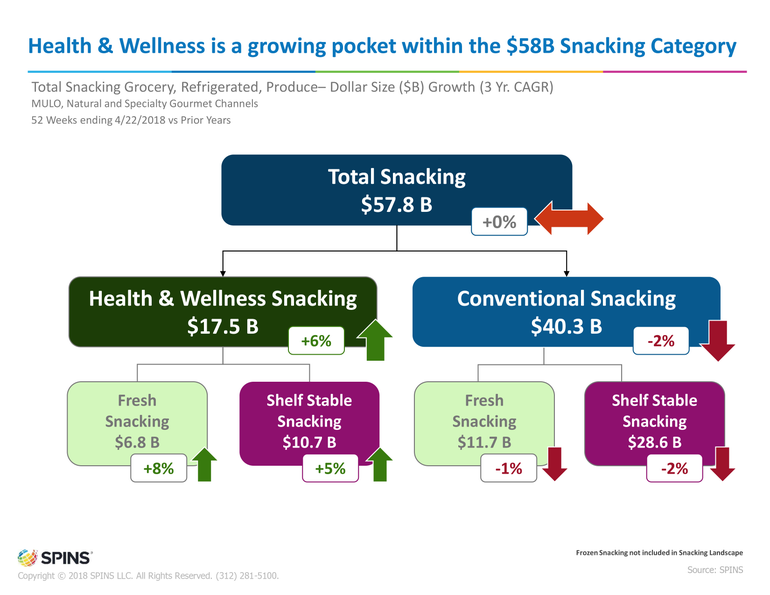

Fresh snacking on health and wellness products constitutes a $6.8 billion segment of an overall $57.8 billion snack market, but it is growing fast—by 8 percent in the year ending April 22, 2018, according to an analysis by SPINS, the Chicago-based company that provides retail consumer insights, analytics reporting and consulting services for the natural, organic and specialty products industry.

Sales of conventional snacks dropped by 2 percent, with both conventional fresh snacking (-1 percent) and conventional shelf-stable snacking (-2 percent) contributing to the decline. (Shelf-stable health and wellness snacking grew by 5 percent to $10.7 billion in sales.)

“Consumers are increasingly seeking out less processed whole foods, as signaled by trends such as the Whole30 diet,” said Andrew Henkel, senior vice president of Brand Growth Solutions at SPINS. “Fresh connects to this movement, as it’s perceived to be closer to source ingredients and further from the bad stuff that gives a product a long shelf life.”

Related: Every U.S. region seeing serious growth in natural food and beverage sales

Many items that are being considered snacks have been consumed at meals for time immemorial, such as meats, cheese, vegetables and fruit. But savvy marketers are now packaging these items in one-serving to-go sizes, either as individual items or as part of one of the hottest categories in all of food retailing: refrigerated snack kits, which according to SPINS had an April-to-April growth rate of 73 percent.

“In some of the meal kits, you have the meat, you have the cheese, but then you have these chocolate-covered almonds mixed in,” said Alice Mintz, manager of growth solutions at SPINS, “which is an interesting way to create a variety in this one little kit, but also it’s bringing an element of the center store into the perimeter. It doesn’t diminish the essence of freshness.”

There are products that have been designed specifically for the consumer seeking both nutrition and snackability. Fast rising in this category are refrigerated snack and energy bars, which were up 50 percent; products in this category include Perfect Bar (up 87 percent versus a year ago) and Phyter (which exhibited at FamilyFarmed’s Good Food EXPO in March 2018).

Then there are products that have long had traction on the perimeter that are now available in new and health-oriented varieties. For example, while traditional dairy yogurt showed a 4 percent growth rate, plant-based yogurt products (most of them made with nuts such as cashews) showed 48 percent sales growth, and drinkable yogurts were up 11 percent. Refrigerated salsas and dips (such as hummus and guacamole) were up 20 percent.

SPINS provided a sampler of fresh snacking products that have enjoyed stratospheric growth rates:

• Chobani Flip S’Mores Non-Fat Greek Yogurt: up 384 percent ($21.4 million)

• Sabra Grab N Go Guacamole Tostitos: up 296 percent ($7.0 million)

• Niman Ranch Sopressata Provolone Olive Snack Pack: up 388 percent ($200,000)

• Juicy Gem Organic Pomegranate Arils: up 85 percent ($900,000)

Because some of these kinds of products have long had a consumer base, it might seem puzzling why it took producers so long to realize the market potential in grab-and-go packaging. Referring to the popular Sabra brand hummus cups, Mintz said, “The timing was right, people are ingrained in hummus and they’re ready to take it and make it more convenient. There have been enough tailwinds where now people are looking for fresh snacks and healthier alternatives through all mealtimes. If they had introduced hummus in cups a long time ago, who knows if it would have worked.”

Dries Zender, a principal in SPINS’ Client Growth Solutions, said there’s another big reason for the rising popularity of fresh snacking: The options are much more appetizing than they used to be. “Technology has really improved product taste,” Zender said. “Consumers no longer must choose between taste and healthy ingredients, you can now have both. Consumers can find any type of vegetable that has been retrofitted into a tasty snacking alternative.”

He also noted that the rate of distribution growth for fresh snacking products is 9 percent, slightly higher than the sales growth rate, which suggests retailers regard this as the wave of the future.

“We would expect that as new items are continually gaining distribution, it’s clear that the retailers are placing big bets around fresh health and wellness snacking,” Zender said. “We would expect this sales growth to not only continue but probably accelerate in the coming years as more distribution items are gaining at the store.”

FamilyFarmed is proud to partner with New Hope Network on this series of articles that will unpack the dynamics driving good food. Each month, this series will feature portraits of the national good food landscape and individual industry sectors, and we will continue to back those insights up with facts provided through our partnership with SPINS.

About the Author(s)

You May Also Like