Grocery shoppers depend on product labels and shelf signage to eat healthily

FMI report outlines the product claims shoppers look for when purchasing food products.

February 6, 2020

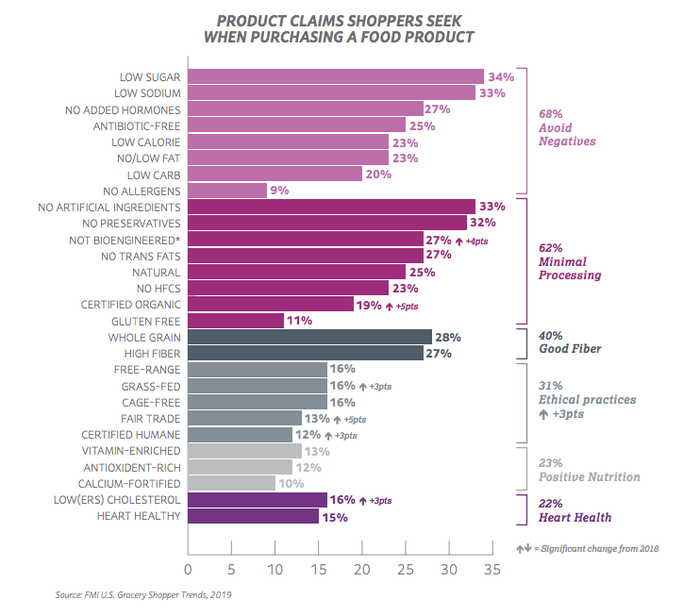

The average supermarket shopper seeks out about six different front-of-package claims when purchasing a food product, according to FMI’s new report, The Power of Health and Well-Being in Food Retail. There is clear momentum for specific product claims, the report notes, including those related to minimal processing and ethical practices.

• Package claims with growing consumer interest include:

• Certified organic

• Fair trade, not bioengineered

• Gluten-free

• Grass-fed

• Certified humane

• Low(ers) cholesterol

In a blog posted today, Hilary Thesmar, PhD, RD, CFS, Chief Food and Product Safety Officer and Senior Vice President Food Safety, FMI, wrote, “Shoppers want to eat well, but the idea of eating well is unique to each person and each household. Eating well could mean following a specific diet, trying the latest food trend or meeting medical needs through food. Often, in order to eat well, shoppers rely on product labels and signage on store shelves to get information that will help guide their eating-well desires.”

FMI’S Retailer Contributions to Health and Wellness 2019, which surveys food retailers about their health and wellness initiatives, lists the following as the top six key food attributes identified on store shelves, according to food retail survey respondents:

• Organic (97%)

• Gluten-free (93%)

• Local (80%)

• Low sodium (60%)

• Heart healthy (60%)

• Kosher (57%)

“It’s clear some of these labeling needs and key food attributes align,” wrote Thesmar, “but there is room to broaden in-store signage to better meet shoppers’ changing desires.” To that end, it’s interesting to note the new shelf identifications offered by food retailers are:

• Cage free (40%)

• Diabetes management (37%)

• Digestive health (33%)

• Fair trade (30%)

• Brain function (27%)

• Immune function (23%)

• Bone health (23%)

• Athletic performance (13%)

“These new shelf identifications aim to help shoppers in their eating-well efforts,” Thesmar wrote. “Shoppers already see food retailers as on their side in their efforts to meet their ideal of eating well and this expanded list of emerging shelf identifications shows retailers are committed to this role and prepared to offer a wide variety of products to assist shoppers.”

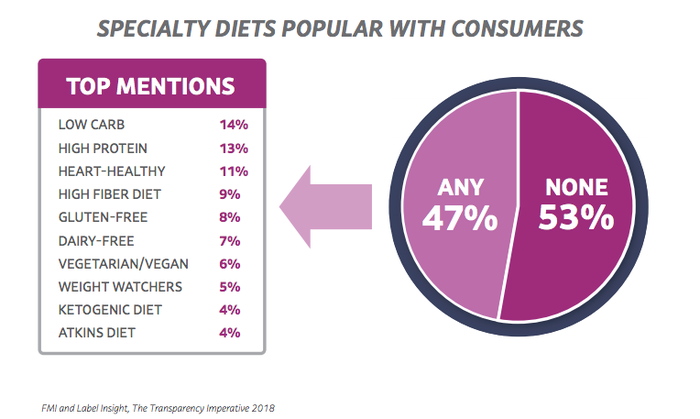

Furthermore, consumers aren’t showing any signs of pulling back on their interest in pursuing specific eating patterns or diets, says FMI. The long list of choices includes low-carb, high-protein, heart-healthy, high-fiber, gluten-free and dairy-free, according to The Transparency Imperative, a report from FMI and Label Insight. Among the diet trends impacting food purchases:

• Diets and medical conditions: Some consumers are pursuing specific diets for medical ailments, even if experts are sometimes mixed about benefits and safety. An example is the keto diet, used by some consumers with diabetes

• Raising the flexitarians’ profile: Some consumers want flexibility in their diets. A recent report from Packaged Facts said that more consumers consider themselves to be flexitarians, a diet that includes both plant-based foods and animal products. About 13% of Gen Z identify as flexitarians, an insight that may indicate future consumption directions for this young cohort.

• Retailers accelerate diet focus: Food retailers are responding to consumers’ interest in diets. About 75% of food retailers expect to increase space allocation to diet-focused foods in the next two years, according to FMI’s Speaks research. The diets cited include paleo, ketogenic and gluten-free.

• Portion control in focus: Portion control isn’t a new concept. Many consumers have long aimed to reduce their portion sizes as a health measure. This is especially relevant today with obesity as a major issue. Consumers in smaller households sometimes complain that products and packaging are aimed primarily at larger households.

About the Author(s)

You May Also Like