.png?width=700&auto=webp&quality=80&disable=upscale)

Market researchers outline natural customer concerns

Confused consumers are turning to simple life (and food) choices. The Natural Marketing Institute and Nielsen offered their thoughts on what this means for the natural products manufacturer and retailer during a session at Natural Products Expo West.

March 26, 2014

If the Natural Marketing Institute (NMI) and Nielsen’s first education session at Natural Products Expo West is any indication of its popularity in future years, they are going to need a much bigger room. The hour-and-a-half session had the packed ballroom (and more than 100 more in the hallway, unable to squeeze in) hanging on every word.

What is the secret to where the markets are going? What will the typical consumer look like and want in 2018? How will buying patterns and shopping practices change in the next five years? How do you talk to a millennial consumer?

What manufacturer, retailer, broker or distributor wouldn’t want these answers? While there were some overarching themes presented, drilling down to more specific answers requires complex long-term market analysis, which is where industry consulting experts NMI and Nielsen stepped in.

The presentation was broken into three parts: the first by Todd Hale, senior vice president of consumer and shopper insights at Nielsen; the second by Steve French, managing partner of NMI; and the third by Maryellen Molyneaux, president of NMI.

Where’s the growth?

The economic recovery has been real, but slow. So Todd Hale asks, “Why has there been no growth in the consumer products industry?”

There are a few main causes for this soft buying recovery, Hale says, most centered around these central factors: our population is not growing (0.7 percent population growth is the slowest rate since 1937); the median household income is slowing and wages are stagnating; fixed expenses are forcing reduced household purchases (prediction: inflation is coming); and the modern economic divide is very real.

Shifts in jobs from manufacturing to retail mean more part-time jobs and less income for many, particularly blacks and Hispanics, setting up a disparity that plays out across all of NMI and Neilsen’s future trend projections.

Not surprisingly, 52 percent of consumers report that high food prices affect what and how they buy. However, other factors are at play as well. Because the modern consumer prefers fresh (or the perception of fresh)—products purchased closer to the date of production—they are “shopping the perimeter” of the store. Thus, purchases are skewed toward meats and deli items, produce and even alcohol. Consumers are also spending more time at home rather than eating out, necessitating more trips to the grocery store.

So where will the growth occur? Hale predicts it will be in e-commerce and natural gourmet grocers. Amazon Fresh and other delivery modalities are expected to surge, and most storefront growth will come from niche and gourmet grocers like Trader Joe’s and Fresh Market on one end of the spectrum and discount chains like Aldi’s on the other.

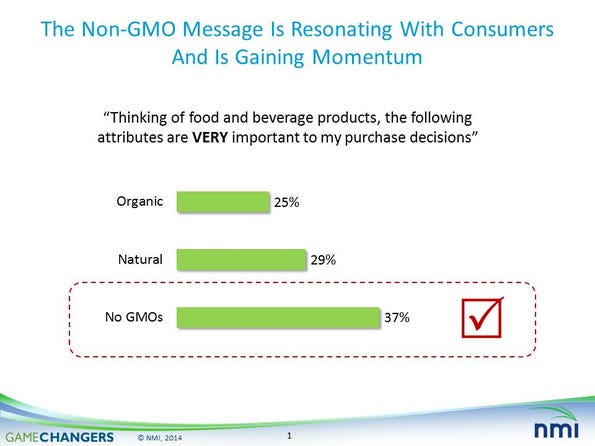

Label claims are also becoming key, with messages such as “low glycemic,” “non-GMO” and “gluten-free” driving purchasing decisions more than ever (even “organic” is making a comeback, growing more than 10 percent a year over the last three to four years). Meal trends like snacking, convenience, ethnic and semi-scratch cooking options are ones that manufacturers and retailers alike should look to capitalize on in order to “win" the shopping trip.

The alternative consumer

The modern consumer will be looking more than ever for “alternatives to alternatives” in every aspect of their lives, says Steve French. Bike-share programs eliminate the need to purchase a bike and make short commutes easy and green. Solar, wind and hydro-electricity are eco-friendly alternatives to coal and gas. Crowd-sourced funding solves the problems associated with venture capital. Nut, soy and rice milks are vegan answers to the desire for milk. Meat substitutes abound. Even clothes-line usage is up, as consumers seek alternatives to reduce their dependence on electricity.

Much of what’s old is new again, and the modern consumer is focusing on well-being to make their choices. Less meat, fewer artificial ingredients (and fewer ingredients in general), reduced processing of food, sustainable fair trade, low planetary impact, food as medicine, healthy convenience … these are all trends we will be seeing from the new focus on finding alternatives to meet consumer demand.

Manufacturers and retailers should also be aware that tranparency will be a significant driver of consumer purchases in the future, French says. Consumers are beginning to look not just for claims of social and environmental responsibility, but they are also demanding proof. Evidence of alliances with NGOs (non-governmental organizations), use of independent verifiers and demonstrated monetary commitments to sustainable programs are all going to be influencers of brand choice and loyalty.

We are all aware of the new importance of clean labels, but did you know that more than 50 percent of consumers now report that they read labels on foods and beverages and select foods based on short and recognizable ingredients? This trend reflects the growing consumer desire for more control over what they are consuming. The No. 1 area in which they want control is food allergens (11 percent); No. 2 is organic ingredients (10 percent).

Retail gatekeepers like Whole Foods Market will make it easier for label-reading, socially conscious consumers to shop, so consumers concerned about having control over food and brand choices will gravitate to such retailers for help. What can you do to help consumers shop with these things in mind? Build your business around those innovative changes and you will reap the rewards. Transparency is the new green.

In addition to these overarching themes, French identified four key new product drivers:

Healthy convenience from on-the-go bars, lunches, drinks, packs and other formatting changes will attract consumers. Convenient purchasing opportunities (like the aptly-named “convenience stores”) will also gain buyers.

Protein as a power nutrient has made a resurgence. New sources like pea protein are becoming more popular.

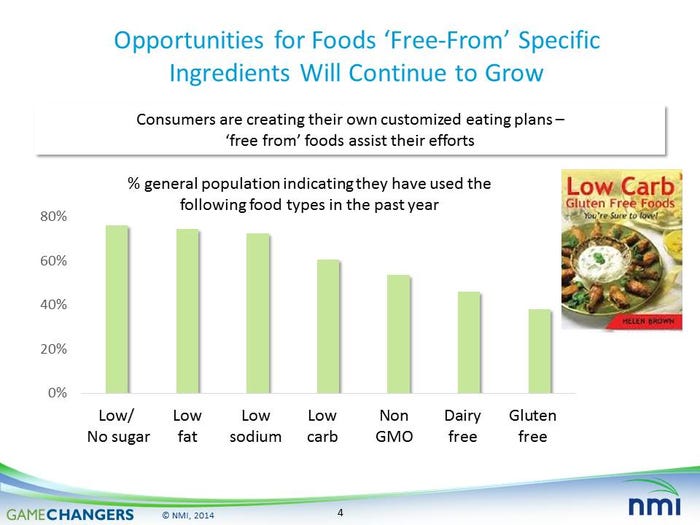

“Free from” products offer significant growth categories, as consumers create their own customized eating plans. Gluten free, for example, was a $22.3 billion dollar sales category in 2013, with 4 in 10 consumers buying gluten-free foods, even when it wasn’t medically necessitated.

Raw. Raw. Raw. The more natural the state of the food, the better. Whether for health, detox, weight loss or something else, two-thirds of consumers are looking for raw.

Labeling and the modern consumer

Labeling is a problem for today’s customer. While the desire for healthier products is very real, there is a significant gap between labeling and consumer perception, necessitating more consumer education in the future, says Maryellen Molyneaux.

For example, more than 50 percent of the American population believes that the “natural” claim on a product means that no pesticides were used. At the same time, there is a growing distrust over whether “natural” means anything at all. With regard to the hot-button issue of non-GMOs, only 5 percent of consumers believe they even understand GMOs, yet 37 percent of them say they are more influenced by a “non-GMO” label, than by an organic one, demonstrating that they do not fundamentally understand that “organic” always also means “non-GMO.”

To allay consumer skepticism and confusion, certification labels will go a long way to providing validity. USDA organic labels should come with more information, and “natural” products must find a new, helpful way of describing themselves (perhaps a claim of “simple” ingredients would be better?).

Whereas labeling has proven complicated for the modern consumer, there have never been more ways to shop, Molyneaux says. “Shopping the perimeter of the store” has never been more popular, and online shopping is projected to double by 2017. Retailers will seek to capitalize on these trends by redesigning floor areas to maximize the perimeter and more lifestyle shopping experiences will be combined (barbers, bookstores, coffee shops, etc. all under one roof).

The millennial connection

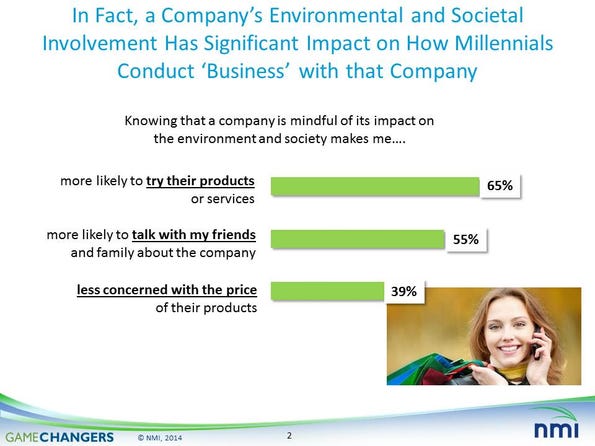

Finally, no discussion of trends would be complete without a foray into the millennial consumer. These young adults born between 1977 and 1995 make up a highly influential consumer group with vastly different values and needs from those of earlier generations. More than 80 million strong, these buyers are tech savvy, impatient, experienced in social media, well-educated and short attention-spanned early adopters who like to tell others about their purchases and priorities. Importantly, they are also actively concerned about protecting the planet and its people and will choose companies that align with these social missions.

Millennials will choose to purchase from companies who align with and make it easier for them to follow through with their social and environmental aspirations, Molyneaux says. Simply put, if your company doesn’t have a legitimate, clear social or environmental mission that is easily explained to this generation of buyers, it will lose sales to another that does.

Make your philanthropic actions known through social media and make it easy for Millennials to buy from you rather than the competitor, and you will reap the rewards in the coming years.

Jules Shepard is an active writer and business owner in the gluten-free realm and blogs regularly at julesglutenfree.com. She covered Natural Products Expo West as part of New Hope's We.Blog editorial team.

About the Author(s)

You May Also Like