SNAP grocery shoppers show affinity for store brands

PLMA study finds private label could help beneficiaries stretch food dollars.

September 7, 2021

New research from the Private Label Manufacturers Association (PLMA) sheds more light on the grocery shopping behavior of Supplemental Nutrition Assistance Program (SNAP) participants, including a propensity for store brands.

Titled “Stretching Food Benefits: SNAP Recipients Speak Out on Shopping and Store Brands,” the study is believed to be the first national survey on SNAP beneficiaries’ monthly food buying habits that focuses on private-label purchases, PLMA said. A nationwide sample of more than 500 SNAP recipients took part in the poll, conducted in early 2021 by global online researcher Surveylab.

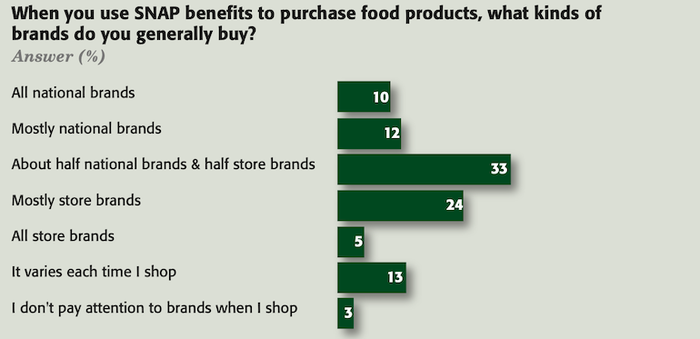

About three in 10 participants in SNAP—formerly known as food stamps—buy private brands at a high rate each time they shop for groceries, PLMA’s research found. Twenty-four percent of respondents said they mostly buy store brands, and 5% reported purchasing only store brands. Another 33% indicated they buy about half store brands and half national brands.

Overall, 22% of SNAP shoppers focus on national brands, with 10% saying they buy all national brands and 12% purchase mostly national brands. Thirteen percent reported that their brand selection varies each time they shop, while 3% don’t pay attention to brands when shopping.

“The purpose of the study is to determine the habits and attitudes of recipients towards shopping in general and store brands in particular and, with those findings, produce a marketing and merchandising roadmap that retailers can use to encourage SNAP customers to spend more of their monthly benefits on store brands, thereby stretching their food dollars,” PLMA President Peggy Davies said in a statement.

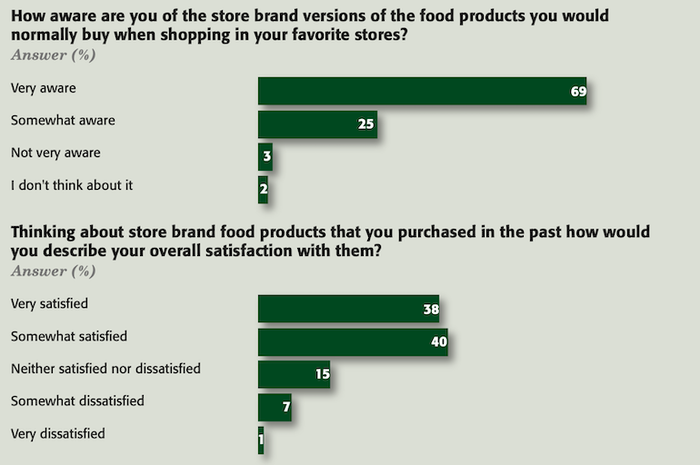

SNAP beneficiaries show high familiarity with private brands, according to PLMA. Of those polled, 69% said they’re “very aware” and 25% said they’re “somewhat aware” of store brands. What’s more, over three-quarters of SNAP shoppers expressed satisfaction with private-label groceries, including 38% reporting they’re “very satisfied” and 40% saying they’re “somewhat satisfied.” Just 8% voiced dissatisfaction with store brands.

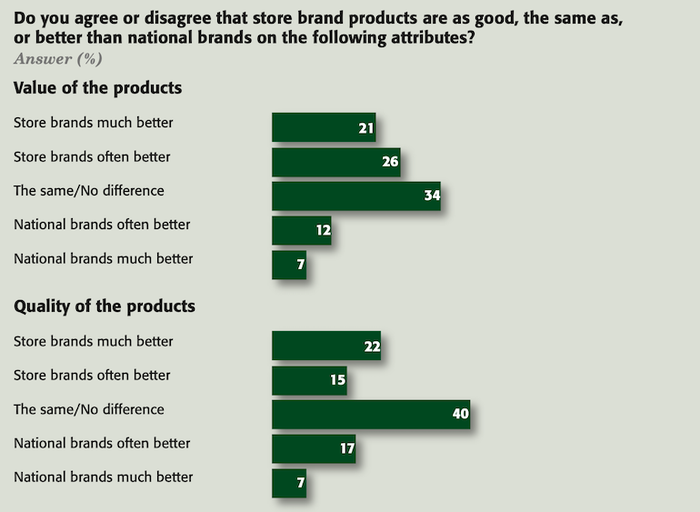

PLMA noted that SNAP users rated private brands better than national brands on five of six key product attributes. Unsurprisingly, store brands led on value, with 47% of SNAP participants surveyed citing private label as offering “much better” or “often better” value than national brands. Less than half that percentage (19%) said national brands provided more value. Meanwhile, 37% of respondents named store brands as offering better quality, including 22% describing private-brand quality as “much better” and 15% as “often better.” That compared with 24% who consider national brands higher in quality.

Private label also came out on top among SNAP beneficiaries in terms of in-store promotions (35% cited store brands versus 27% for national brands), packaging (30% store brands vs. 22% for national brands) and food product performance (28% for store brands vs. 25% for national brands). However, national brands edged out private brands in taste at 29% to 24%, respectively.

Still, many SNAP users who prefer national brands have had good experiences with private label, PLMA pointed out. Among those who purchase all national brands with their SNAP benefits, 18% are satisfied overall with store brands they have purchased in the past. Similarly, 23% of those who buy mostly national brands express similar satisfaction with store brands.

“Expanding store brand sales among this group of consumers can be beneficial to all parties,” Davies explained. “For the SNAP shopper, whose savings realized from opting for store brands could then be spent on additional SNAP food items in the store for their household. For the retailer, who would increase high-margin private-label sales, affirm marketplace differentiation, and strengthen consumer loyalty with an important and sizeable demographic. And for the program itself, by effectively getting more food products into recipients’ households for the same amount of federal dollars expended.”

The study findings show SNAP recipients to be “careful shoppers,” according to PLMA. Eight in 10 always or frequently buy SNAP-eligible products when on sale, and the same percentage typically use all or nearly all of their monthly benefits. Notably, 59% said marking SNAP-eligible items on supermarket shelves would be helpful.

By channel, 66% of respondents reported using their SNAP benefits supermarkets (such as Kroger, Safeway, Albertsons), 59% at mass merchants (Walmart, Target), 47% in dollar stores (Dollar General, Family Dollar), 26% at discounter grocers (Aldi, Save A Lot), 26% in drugstores (Walgreens, CVS), 21% at club stores (Costco, Sam’s Club, BJ’s Wholesale) and 15% in specialty grocery stores (Whole Foods Market, Trader Joe’s).

PLMA found that SNAP beneficiaries are active online consumers. Thirty-one percent order food from restaurants for home delivery or takeout, 25% buy groceries online for store pickup, 25% purchase products online for home delivery, and 20% order groceries online through services like Instacart and DoorDash. Almost half of SNAP recipients said they would use their SNAP benefits for online food shopping if their preferred grocery stores enabled them to do so.

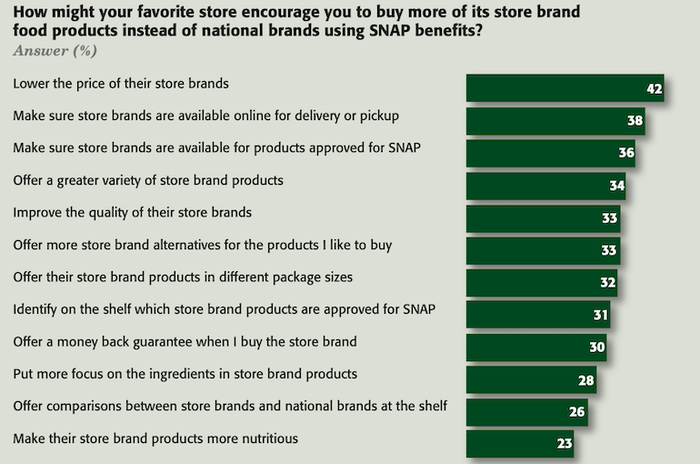

SNAP shoppers also identified ways that retailers and suppliers could spur them to buy more store brands. The highest percentage of those surveyed (42%) cited lower prices for private brands, followed by 38% who called for stores to ensure their store brands are available online via SNAP for home delivery or pickup. Thirty-six percent said stores need to ensure SNAP-eligible private-label products are always available, and 34% want more variety of SNAP store-brand items.

Other suggestions from respondents included offering more private-brand options for products they like to buy (33%), improving the quality of store brands (33%), providing on-shelf indicators for SNAP-eligible private-label products (31%), presenting on-shelf comparisons of store- and national-brand items (26%), and serving up meal ideas using SNAP-eligible private-brand products (21%).

The cost benefit for store brands can be significant, PLMA noted. In related research, the association sponsored the purchase of typical market baskets of about three dozen SNAP-eligible food products over a four-week period. The average savings for the store-brand products bought versus their national-brand counterparts was 38% at a major Northeastern supermarket and 50% at a leading national mass merchant, PLMA said.

“Increasing their purchase of store brands with SNAP benefits is up to individual shoppers, of course,” PLMA’s Davies added. “Still, U.S. retailers, consumer groups, NGOs [non-governmental organizations], and even key federal and state agencies can play an important role in combating food insecurity and rising prices by pointing out to recipients that they can stretch their benefits significantly by choosing more program approved store brands.”

Run by the U.S. Department of Agriculture, SNAP represents a sizable chuck of the U.S. grocery market. Citing USDA data, PLMA reported that 42.3 million people (about 20% of U.S. adults) and 22.1 million households were enrolled in SNAP as of April 2021, with the total monthly benefit cost at $9.6 billion, up 26% year over year. Average per-person and per-household benefits were $203 and $386, respectively. Under the Biden administration, USDA plans to raise the average SNAP benefit by $36.24 per person monthly effective Oct. 1—the first change to the program’s purchasing power since 1975.

In 2020, U.S. grocery retail sales across outlets totaled $816 billion, including $404 billion for supermarkets, according to Nielsen data cited by PLMA. In comparison, SNAP food expenditures last year were $79 billion at authorized stores, plus associated program costs. For 2021, USDA projects total SNAP spending at more than $100 billion.

About the Author(s)

You May Also Like