At a Glance

- Supplements industry booms to $63 billion.

- Did someone say boom? How about mushrooms?

- Channel dynamics, specific ingredients mentioned.

How healthy is the US dietary supplements market? Let us count the ways.

“It’s a really strong industry,” said Bill Giebler, content and insights director for New Hope Network's Nutrition Business Journal at a state of the supplements industry session at Natural Products Expo West. “At $63 billion, it’s about $2 billion more than we predicted it would be before that little thing called COVID. We expect $13 billion more growth between now and 2026.”

Driving the news are the supplements trends around sports nutrition, women's health, mushrooms, delivery formats and the range of popular specialty ingredients. Click here to see product examples from the show floor at Natural Products Insider, a New Hope Network sister site.

Start stocking the news—but, maybe, not so fast, beloved natural brick-and-mortar retailers.

That’s because, although $63 billion is a new record, consumers looking for deals flocked to Amazon, driving nearly 9% year-over-year gains in supplement sales in that channel, according to NBJ estimates.

Also speaking at Natural Products Expo West, NBJ Market Research Analyst Erika Craft noted the overall mass market experienced 5.1% growth, with the premiere natural channel exhibiting a flat 0.6% growth for 2023.

“Ecommerce is growing over supplement industry growth as well,” said Craft. “Consumers are still seeking out the more affordable options.”

However, with inflation subsiding, natural independent retailers are hoping their supplements' fortunes turn around, especially because supplements provide the highest margins of any products in their stores.

“The natural specialty channel continues to lose market share to other growing channels,” said Craft. “The mass market is really starting to grow and take up a piece of that.”

A piece of good news in the numbers is that while most of the growth in the last year or two was because of price increases—you can thank COVID-related supply chain snarls like shipping for costs going up by a factor of 10—“things are now growing in both dollars and units,” said Scott Dicker, market insights director at SPINS, during the Expo West symposium.

5 supplement trends for 2024

Other than that channel story, there is a lot of consumer acclaim and sales success in specific health conditions and hot ingredient categories.

“While we all love new and exciting ingredients coming out,” said Dicker, “the fastest-growing supplements have been established ingredients finding new audiences.”

Sports nutrition

Sports nutrition is emblematic of this sentiment, with all-stars like creatine finding women and electrolytes finding hungover Gen Z’ers. In sum, sports grew a healthy 8.5%, which is expected to continue with a 7.1% growth in 2024, said Craft.

The leading ingredients here are powered by preworkouts, creatine, hydration and sports powders. Powders in particular can thank not just protein, but whey protein. That’s right, whey's got its groove back. Remember how everybody was glomming on to plant proteins? Take that, said whey, which grew a muscular 21% last year, according to SPINS research, and is again tops in both growth and market share.

“No longer do females think it will add bulk,” said Dicker, of the larger protein market with women. He pointed to liquid RTD protein drinks, which experienced year-over-year growth of 18%. Got Muscle Milk?

In the year ahead, Dicker said he can envision beet root rising in prominence because of its ability to act as a nitric acid booster, which improves blood flow and downstream cardiorespiratory endurance, as well as improves the number and efficiency of mitochondria, and it strengthens muscle contraction. “Beet root this year,” said Dicker, “creatine last year, ashwagandha the year before that.”

Dicker mentioned that while preworkouts are up 9% and energy drinks are up 14%, creatine is up a “fantastic” 47% and hydration and electrolytes have “really taken off” and are up 52%.

In sum, the combined sports/energy/weight category represents one-third of all supplements sold in 2023, said Giebler, with immunity in second place at 8.3% market share although immunity sales were flat for 2023.

Specialty ingredients

Specialty ingredients came in second place, clocking in at a 4% growth rate. These are ingredients like collagen, probiotics, omega-3s, 5-HTP, melatonin and coQ10.

Biotics in particular—probiotics, prebiotics, postbiotics, synbiotics—enjoyed 34% growth in pre- and probiotic capsules, with powders coming in second at 29% growth, said Dicker. [For a deep dive into all things biotics, download the free Natural Products Insider digital magazine on the subject.]

Women's Health

Women’s health supplements in particular are getting serious. At least five segments in particular are to account for that.

One is perimenopause—the time leading up to a women’s last menstrual cycle, punctuated by hormonal changes and cycle irregularity. This phase can last from four to eight years, according to the North American Menopause Society. Supplements here, according to Pamela Peeke, M.D., host of the HER radio show podcast and spokesperson for the Solaray supplements brand, tend to address symptoms such as mood swings, difficulty sleeping, hot flashes, night sweats, weight gain and changes in sex drive.

Solaray recently released its Her Life Stages lineup with five SKUs: PMS and menstrual, libido, perimenopause, menopause and postmenopause.

Second is creatine, which has found the female demographic. “There are so many tried and true ingredients like creatine and HMB marketed as ‘Get bigger get stronger get faster,'” said Rachel Jones from GNC at a women’s health panel at Expo West, "but these have tremendous potential for women who want to maintain lean muscle mass and metabolism.”

Third is libido. “Women actually love to be speaking up front as being sexual beings,” said Karen Hecht, Ph.D., scientific affairs manager at ingredient supplier AstraReal, at the panel.

Fourth is the one that started it all—digestion. “Fiber is the new protein,” said Julie Gordon White, founder and CEO of MenoWell bars, at the women’s panel. “Fiber needs to be made more sexy. Get your fiber. Eat whole foods first. Fiber is the new thing.”

Natural Factors just released a new nine-strain probiotic Women’s Ultra Ultimate Probiotic formula containing a rather large 55 billion CFUs to restore intestinal health.

And fifth is, of course, natural beauty. The natural landscape is led by brands like Dr. Bronner's, Maile and Acure. “Natural beauty is a growing space with accelerating growth,” said Alice Mintz, the SPINS director of solution architecture. “Natural used to hold an 8% share, and now it’s 10% and has grown to $5.5 billion. Overall natural beauty last year grew 20.2%.”

Non-pill formats

Non-pill formats continue their domination. The pill formats—tablets, capsules, softgels—were flat in sales, said Giebler. “All the other things are growing: chewables, effervescents, liquids, lozenges, lollipops, powders, shots and, of course, gummies,” he said. “We think we’re nearing the ceiling of gummies, however, but it’s hard to predict that.”

Mushrooms

Mushrooms are catching the wave of completely natural and unadulterated and unprocessed plants that are being legalized. We’re talking about the cannabis continuum from marijuana legalization to the hemp CBD boom (which has fairly crashed since COVID, but still). And we’re also talking about the growing cultural acceptance of psychedelics—a marijuana dispensary in California was showcasing two large jars of straight-up psilocybin magic mushrooms for sale!

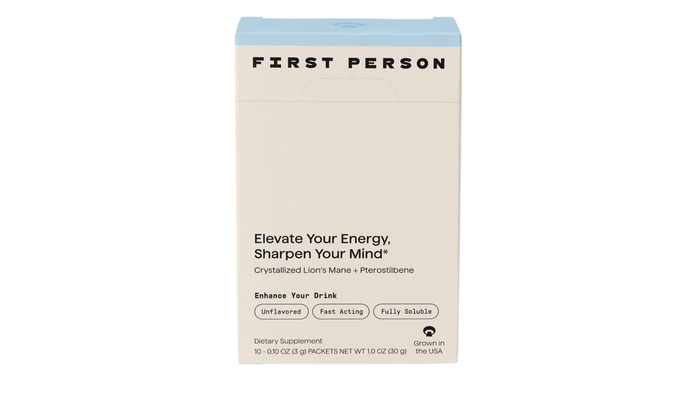

While psychedelic ’shrooms are not sold as supplements, other mushrooms surely are. Every Natural Products Expo has an ingredient that is the star of the show, and for Expo West 2024 that was mushrooms. Reishi, chaga, agaricus, and especially the nootropic lion’s mane were all on exhibit.

Sandra Carter, Ph.D., founder of the OM Mushroom Superfood supplement line that is undergoing a huge facility expansion in San Diego, asserted that while lion’s mane is grabbing all the attention this year as a star of the popular nootropic category, she believes the endurance-enhancing cordyceps is the one to watch next.

Will that actually pan out? We’ll have to wait until Natural Products Expo West 2025 to find out!

Correction: Bill Giebler's quote about non-pill formats was corrected on March 28, 2024.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)