The new state of plant based – article

November 17, 2022

Sponsored by NielsenIQ

Plant based eating has come a long way from the dried textured vegetable protein available in the health stores of the past. Walk into any grocery store now and you’ll likely see plant-based products prominently displayed on shelves near the conventional products they may be substituting. Plant based is no longer niche—it’s very much mainstream.

“Consumers are more concerned than ever about personal and family health. They see food as medicine, and plant-forward eating is part of that,” says Sherry Frey, VP of Total Wellness at NielsenIQ. According to MoviBase, a NielsenIQ Connected Partner, about 30 million consumers are engaged in plant-based trends.1 “At the same time, as an industry, we've launched so many more products into the space,” says Frey.

Sales of plant-based products grew 8% last year, but a whopping 54% since 2019, expanding total worth of plant based to approximately $9.7 billion.1 Such impressive growth shows that consumers are more willing than ever to try—and adopt—plant-based options. Yet research also shows that consumers are equally confused about what plant-based means.

According to FMI and NielsenIQ’s recent report, “Power of Plant-Based,” 42% of shoppers try to eat plant-based—broadly defined as consuming plants versus animals.1 Simultaneously, these consumers want to reduce processed food consumption. For single-ingredient buys, like apples, the choice is easy, but faced with multi-ingredient products, such as alternative burger patties, consumers are uncertain what to look for.

Given consumer confusion, the breadth of the plant-based market, and the rapid innovation of new products, how can brands and retailers best navigate this megatrend? How will product innovation and store SKU selections need to adapt to better meet consumer expectations? According to the latest insights from NielsenIQ, here’s what you need to know.

Consider how plant based intersects with other high-growth consumer concerns

For shoppers, “plant based" often signals that a product meets multiple needs and aspirations in a single choice. It represents a sweet spot for consumers, says Frey. Many people have tried plant forward diets like Whole30 or a Mediterranean diet, she says, so plant forward eating is becoming more the norm, but it doesn’t stop there. “Particularly over the last several years of the pandemic, consumers are purchasing products that are healthier for them and their families, but they��’re also looking for products that address animal welfare, social responsibility and environmental stewardship concerns.”

For example, plant based may be a shortcut for shoppers adopting “flexitarian” eating habits for health and environment reasons, e.g. diversifying protein choices while avoiding meats and animal products at certain meals or on particular days of the week. For others, plant based is both healthier and a solution to animal welfare and/or climate concerns.

Shoppers that regularly choose meat alternatives say they do so for taste (43%), health (39%) and nutrition benefits (36%). The same shoppers cite these values as important to their choice: animal welfare (21%), concern about environment/climate (21%), concern about global food supply (19%), convenience (19%), shift in eating approach (15%), cutting back on dairy (15%) and allergies/intolerances (11%)1.

NielsenIQ tracks online consumer searches in addition to in-store purchases. Recent data shows 600,000 searches for “plant based” with 6% growth year-over-year. Searches for “vegan” are at 7 million, “dairy free” at 2.1 million.

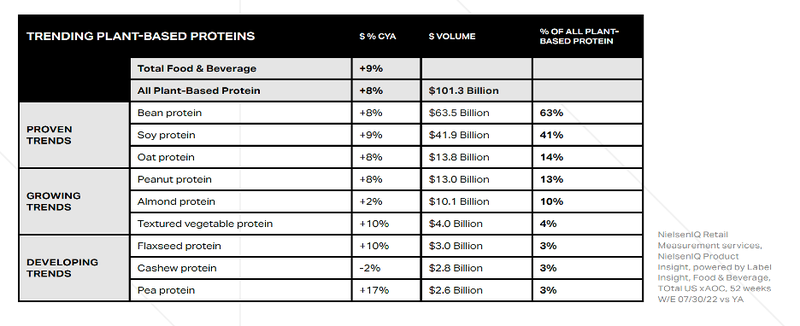

Areas of plant-based growth & innovation

Plant-based purchases are showing strong growth across categories, including beverages (+300% vs 3YA), eggs (+2400%), diet and nutrition products (+41%), salty snacks (+90%) and frozen desserts (+137%). Dairy alternatives, the “gateway” to plant-based eating, grew 23% over 3 years. Sales of fresh meat alternatives grew an impressive 2,587% but are still only about 1/8 of the dairy alternative market.

“We’re seeing so much innovation across categories,” says Frey. In plant-based alternative meats, for example, innovation continues in fresh, frozen and deli, but has added products like jerkies and seafoods, cites Frey. "Companies are rolling out plant-based desserts, snacks and ‘indulgent’ products.”

Companies of all sizes are successfully innovating in plant based. “It's not just small brands or big brands,” says Frey. “Innovation is pretty evenly split between large and small brands. There's a level playing field for any brand to play in this space.”

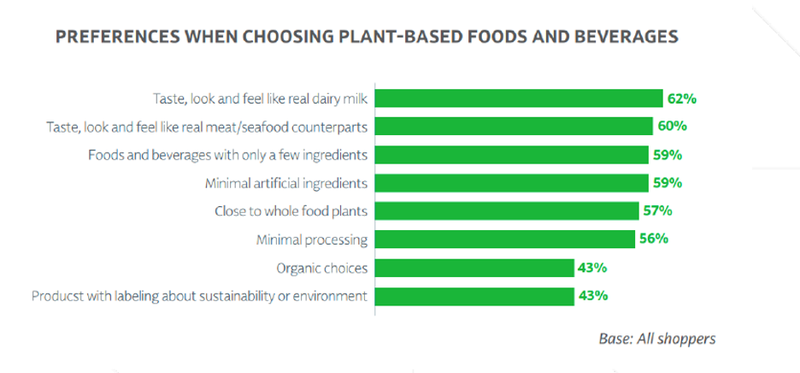

Despite growth, consumers are getting choosy, warns Frey. “We’re seeing trial decline,” she says. They’re more likely to try and adopt a product if it meets taste (tastes good, tastes like the conventional counterpart) and health standards (clean label, whole foods, minimal or no processed ingredients).

Also, consumers may not know what they want. New products don’t have to be an analog for something conventional, explains Frey. There’s opportunity to hit on new innovations that consumers may not even realize they want.

1

1

2

2

At shelf, protect shoppers from the halo effect

As the market grows, so does use of plant-based claims. “We’re seeing the term all over the store on products that don’t meet consumers’ health criteria, as well as on non-food items like tampons, diapers, nail polish,” says Frey. “In some cases, the term is nothing more than marketing hype.”

Consumers want more than just a convenient substitute. “They are considering: Is the product nutritious? What is its sugar and fat content? Is it heavily processed and made with artificial ingredients? Is it better for the environment?” says Frey. Retailers have an opportunity to assist consumers in selecting plant-based products that are truly healthier, more nutritious and gentler on the environment.

Keep a pulse on plant based 1

NielsenIQ is the leader in providing the most complete, unbiased view of consumer behavior, globally. Powered by a groundbreaking consumer data platform and fueled by rich analytic capabilities, NielsenIQ enables bold, confident decision-making for the world’s leading consumer goods companies and retailers.

Using comprehensive data sets and measuring all transactions equally, NielsenIQ gives clients a forward-looking view into consumer behavior in order to optimize performance across all retail platforms. Our open philosophy on data integration enables the most influential consumer data sets on the planet. NielsenIQ delivers the complete truth.

1 Pulse on Plant Based Foods, 2022 Ebook

2 Understanding Plant-Based & Alternative Protein Trends and Opportunities - Presentation, Aug 2022

You May Also Like