Meat alternatives call for merchandising moxie

Retailers can boost awareness and sales of plant-based meats with well-placed, balanced assortments, analysts and marketing experts say.

July 19, 2022

Though sales have been slow-going for plant-based meats, the category is ripe for expansion as more suppliers launch products and pricing migrates toward that of traditional meats.

Unit sales for refrigerated and frozen plant-based meats totaled 17.2 million for the four weeks ended April 24, down 8.3% from a year earlier, according to Chicago, Illinois-based CPG market research firm IRI. Pound sales for the period declined 6.4% to $12 million, while dollar sales edged up 0.7% to $92.3 million, lifted by inflation.

To ignite shopper interest and maximize department revenues, retailers must find the right merchandising balance for plant-based and conventional meats and identify the best areas of the store to display them, says Anne-Marie Roerink, president of 210 Analytics LLC, a San Antonio, Texas-based market research and marketing strategies firm.

"Household penetration is stalling out at around 10%, with high levels of trial. So the all-important discussion is rightsizing the assortment to optimize sales in the meat department altogether," she notes. "Having too many plant-based selections means you are using a slot where a better-moving item could have been generating higher sales. But being under-spaced can mean that a shopper who is interested in plant-based meat alternatives will leave empty-handed."

SKU rationalization can help retailers determine the amount of space to allocate for plant-based meats, says Jim Wisner, president of Wisner Marketing LLC, a Gurnee, Illinois-based retail consultancy. For example, such research could reveal a need to expand the refrigerated meat section to accommodate plant-based products and reduce space in adjacent areas to compensate for the expansion.

In turn, retailers should identify the best-selling and less-consequential items when determining the plant-based selections to offer, Wisner adds.

"If shoppers stop buying item 'B' every time product 'A' goes on sale, you probably don't need item 'B' because it is substitutable in the customer's mind," he explains. "Operators need to determine how much of a purchasing decision is price-driven versus product- or brand-driven."

Proper store placement is vital for sales

Store placement also plays a pivotal role in merchandising plant-based meats and growing the category, according to analysts.

Situating plant-based meats in multiple areas will enable retailers to raise visibility and address different shopper journeys, Roerink says. For instance, vegans and vegetarians "are not thrilled in having to go into the meat department and would rather see the products in the produce or frozen sections," she points out.

However, a 2020 test by San Francisco, California-based Plant Based Foods Association (PBFA) and Cincinnati, Ohio-based The Kroger Co. found that plant-based meat sales rose 23% when these items were placed in the meat department.

That's the approach discount grocer Aldi U.S. takes. The Batavia, Illinois-based chain, with about 2,150 stores in 38 states, is among the retailers merchandising plant-based options in the meat section alongside conventional beef, chicken and pork. Aldi stores carry such selections as the frozen Black Bean Chipotle Burger and Chickenless Tenders under its Earth Grown brand.

"We like to keep grocery shopping fast and convenient, so it makes sense to have plant-based products throughout the store near the traditional offerings," says Joan Kavanaugh, vice president of national buying at Aldi U.S.

Still, generating trial from shoppers not familiar with plant-based meats remains a challenge, Kavanaugh notes. Aldi is working to spur activity by mimicking "tried-and-true meat favorites," such as offering flame-grilled protein burgers and chickenless patties, she adds.

"Patties help first-time plant-based meat eaters try something new in an approachable way," Kavanaugh says.

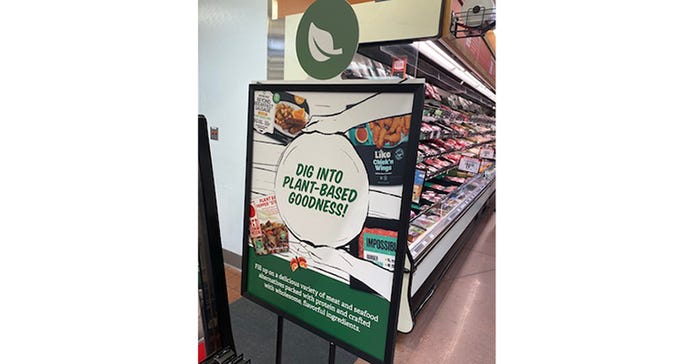

Using point-of-sale markers such as tags, signs and dividers to spotlight plant-based meats also enhances visibility, says Russell Zwanka, director of the food marketing program and associate professor of food marketing at Western Michigan University in Kalamazoo. He recommended that plant-based prices be similar to those of conventional meats.

"Unless the customer is a practicing vegetarian, they are mostly trying these products," Zwanka observes.

Stores also can drive trial by offering discounts and cross-merchandising plant-based meats with other meal components to eliminate the need for shoppers to visit other departments to "puzzle together what's for dinner," Roerink says.

"Always have a plant-based meat brand on promotion to satisfy the plant-based meat shopper," adds Julie Emmett, PBFA senior director of marketplace development. "Retailers also can partner with brands to ensure that supply will cover demand to avoid out-of-stocks, especially as animal-based meat prices are increasing."

Merchandisers, too, can use loyalty card data to target shoppers by market and determine the most relevant selections to offer at each store, Emmett noted. "Because plant-based meat skews more toward younger Millennials and Gen Z, digital marketing is also extremely effective," she says.

Ongoing product development that enhances taste and texture and reduce the amount of ingredients will further increase household penetration, Roerink says. "The plant-based, meat alternative area is still very much in flux."

About the Author(s)

You May Also Like