Nearly all U.S. households purchase meat, but most look for sales

FMI’s Power of Meat 2024 report explores the $99 billion U.S. meat market. Find out how inflation, consumers’ preferences and specials affect sales.

April 16, 2024

Even with plant-centric eating on the rise, Americans still love their meat.

New research reveals that 92% of U.S. adults consider themselves either meat eaters or flexitarians, and 74% believe that meat belongs in a healthy, balanced diet. Last year a whopping 98% of U.S. households purchased meat—48 times, on average—generating $99 billion in revenue for retailers, more than any other fresh food department.

These meaty findings come from the FMI, the Food Industry Association’s new Power of Meat 2024 report, which presents survey insights from 1,730 self-described meat eaters and flexitarians nationwide. The report also includes Circana’s 2023 sales data collected from natural grocers, conventional grocers, club stores, drug stores, dollar stores, e-commerce and other retail outlets.

Even though FMI’s survey pool represents the average American consumer and Circana’s numbers aren’t specific to the natural channel, this report provides ample intel that independent natural products retailers will find useful. Power of Meat divulges the latest consumer sentiments about meat, along with key purchase drivers, buying patterns, and the label claims and product attributes shoppers care about most.

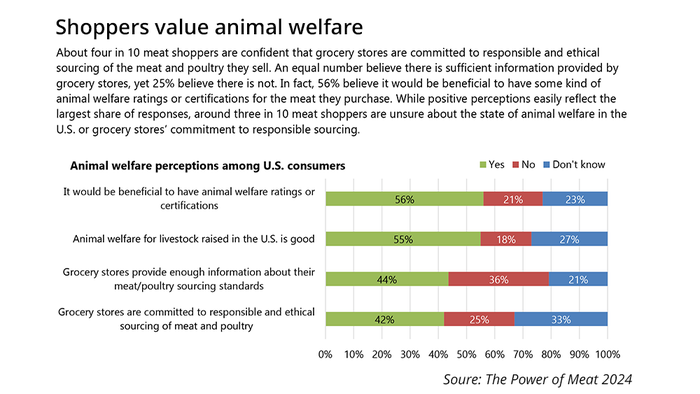

First off, the research demonstrates that the average American grocery shopper is increasingly a conscious consumer. According to FMI’s survey, 68% of shoppers now make an effort to choose healthy and nutritious foods, 64% like to know where their food comes from and 55% try to do their part for the environment. Another 47% of consumers try to purchase food from companies that care about animal welfare and 40% try to buy from companies that care about worker welfare and safety.

As the report reveals, these sentiments definitely factor into shoppers’ meat choices. Also, those who emphasize planet, people and animals tend to favor stores whose values align with their own. That’s all the more reason for independent natural products retailers to communicate and educate around their stores’ sourcing standards.

Inflation has minimal effect on the meat market

While $99 billion is a staggering spend, dollar sales were actually flat for meat in 2023 while unit sales fell 1.9%. These slight declines, FMI reports, were driven primarily by continually escalating food prices pinching consumers’ wallets.

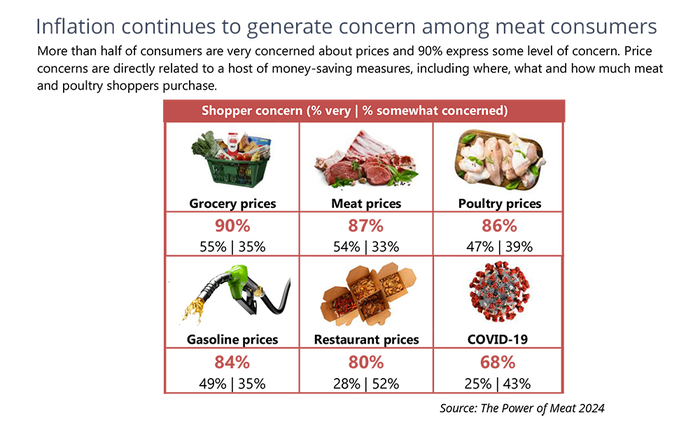

Beef prices rose 4.4% in 2023, while the meat department as a whole saw a 2.1% price hike—less steep than total food and beverage’s 5.9% price jump, but increases nonetheless. Plus, considering that meat prices have skyrocketed 27.5% since 2019, it’s no wonder 87% of FMI survey respondents are at least somewhat concerned about meat prices; 54% are very concerned.

This is prompting consumers to shop differently, with 73% making at least one change to their meat purchasing patterns last year. Along with seeking out more sales and promotions, consumers changed the amounts, types, cuts and brands of meat they shopped for, along with where they shopped for meat. FMI found that 43% are buying larger bulk packs to save money in the long run while 30% of shoppers choose smaller packages to save money that day.

Even so, 91% of consumers can sometimes be persuaded to splurge a little on meat, especially for holidays, special occasions and entertaining. Some also might pony up extra cash for a type or cut of meat they consider healthier, a preferred pack size or brand, or a meat product that offers convenience.

The report also shares some fascinating generational differences in meat purchasing. Gen X, the smallest generation, accounts for 32% all meat purchases, more than any other age group. Baby boomers buy meat the most frequently, averaging 53 purchases per year, but they spend the least money on it, only $14.98 per time. Millennials spend the most on meat per individual purchase, almost $17.

Most shoppers want ‘better’ meat

When buying meat, 83% of shoppers surveyed consider at least one “better-for” attribute around health, animal welfare, planet or social responsibility. While this is down from 85% in 2023, that’s not too big of a drop-off considering continued food inflation and the fact that nutritious, sustainable, ethical meat products often cost more.

As for which better-for characteristics meat shoppers look for most, 66% consider a product’s nutritional quotient, up from 63% in 2023, while 38% weigh the environmental impact, up from 35% last year. After that, 36% of consumers care about farmer and worker welfare and 34% prioritize animal welfare in their meat choices.

The data also suggest that shopper priorities around health, animals, planet and social responsibility usually overlap, with most consumers caring about more than one of these attributes.

Top-priority nutrient: protein

The vast majority (74%) of shoppers see meat consumption as part of a healthy lifestyle, providing essential nutrients and fuel for everyday activities. To ensure that they’re purchasing healthful meat products, 75% of shoppers rely predominantly on on-pack nutrition-related callouts.

As for specific nutrients or attributes, protein is most important to consumers, with 47% of shoppers eying labels for protein callouts. This marks a big shift over the last two decades, as fat and sodium used to top the list. Today, total fat ranks as second most important, mentioned by 42% of survey respondents, followed by calories (38%), sodium (33%) cholesterol (32%), saturated fat (29%) and iron (22%).

But there are some interesting generational nuances around this, FMI reports. Younger consumers typically look for label callouts about ingredients and attributes that they want in meat, whereas older consumers focus on those they don’t want in meat.

For example, Gen Z and millennial consumers are most interested in protein, iron and portion size; millennials also look out for calorie-related information. But then Gen Xers are most interested in callouts about sodium, cholesterol, saturated fat and calories—all of which they’re aiming to limit or avoid. Like Gen Xers, boomers also seek out info on sodium and cholesterol, but instead of saturated fat, they care most about total fat.

Production claims inform meat choices

FMI queried consumers about their perceived impacts of meat production. Overall, 46% of respondents believe that, if done properly, animal farming does not have a negative impact on the environment. That’s down from 49% in 2020. (It’s unclear whether the survey defined “done properly” or left that to respondent interpretation.)

There are stark generational differences here too: Only 27% of Gen Z thinks that animal farming, even when done right, has no negative environmental ramifications. That sentiment jumps to 45% among millennials, 50% for Gen Xers and 57% for boomers.

Consumers who seek out meat that’s better for their health, the planet, animals or people often use production-related label claims, such as organic, free range, grass-fed or locally raised, to guide their decisions. According to the survey, 66% of shoppers purchase meat or poultry featuring such claims at least some of the time. Back in 2015, only 53% did so.

“Raised in the USA” is the most sought-after production claim, favored by 44% of shoppers. Next comes humanely raised (40%), no added hormones (38%), natural (37%), raised without antibiotics (36%), raised locally (34%), free range (32%) grass fed (28%) and organic (22%).

The core consumers of claims-based meat tend to be millennials, especially those aged 32 to 41, and parents of kids under age 12.

About the Author(s)

You May Also Like