How investment in our industry has changed

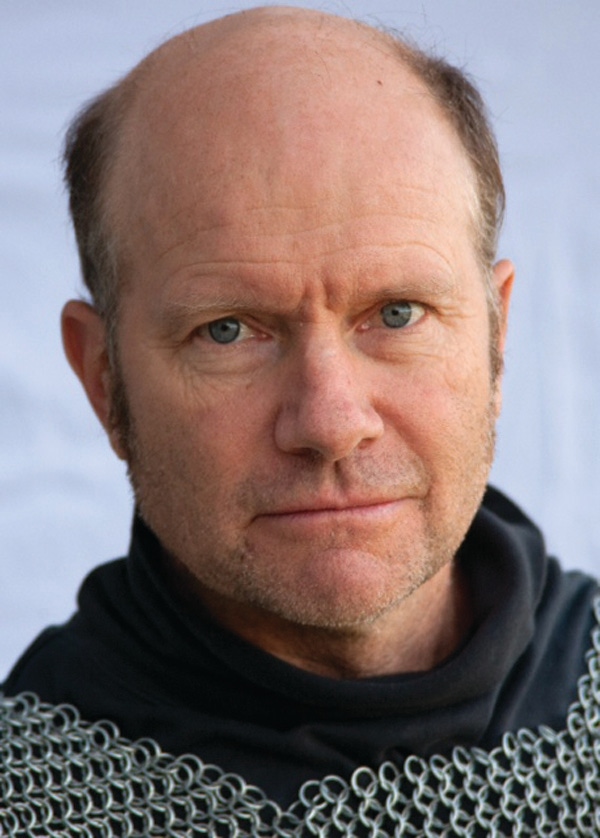

Grant Ferrier, CEO of Nutrition Capital Network, discusses how the industry has changed since the 1990s.

April 5, 2013

Grant Ferrier, CEO of Nutrition Capital Network, discusses how the industry has changed since the 1990s.

Functional Ingredients: You co-founded Nutrition Business Journal in 1996 and are now CEO of Nutrition Capital Network. How has the nature of investment in the nutraceuticals business changed over the years?

Grant Ferrier: Probably the biggest change is what is regarded as an early-stage company, but to understand this you have to understand the basic types of investors.

You have the startup phase of founders, friends and family, and angel investors. Then you have venture investors who are open to investing in early-stage companies that aren't yet profitable. Then you have private-equity investors who prefer to only invest in profitable companies looking to scale a proven business model. You also have a number of strategic investors in our industry from food, pharma, consumer goods and ingredients who will on occasion invest in earlier-stage companies, but whose ultimate financial interest is usually acquisition of companies or brands.

What has changed is what is regarded as early stage. A decade ago a nice branded product in a defined category and in a defined distribution channel could generate a lot of investor interest with maybe only $200,000-$500,000 in sales. Now the bar is higher and it is not just about sales volume. In consumer health products, sales growth and customer testimonials aren't enough. Unique formulations, intellectual property assets and IP protection, scientific validations for claims and ultimately clinical trials are needed for professional investors and acquirers.

So I think the biggest change is that for companies to seek professional investors or strategic investors, that bar has risen along with the size of the industry and the sophistication of these strategic partners. This puts more weight on the friends and family and angel investors part of the chain, and frankly not many entrepreneurs can draw on these to get the $1 million plus they may need to get a company to the 'early-stage' level that will land VC, PE or strategic interest.

FI: Where is the money coming from these days? Who is interested in our industry?

GF: Probably the biggest changes are the interest of CPG companies in supplements like P&G buying New Chapter and Reckitt buying Schiff. The fact that supplements grew faster than almost all consumer categories throughout the recession intensified the interest of food and pharma, but these guys are getting outbid by others who feel they can't be left out.

Ultimately the fundamentals that drive the industry like the aging population, active lifestyles, disdain for conventional healthcare or sickcare and the fact that still a minority of the population take supplements consistently attract interest from all sides.

FI: How are climate change issues impacting business decisions?

GF: Hardly at all, I'm afraid. With no economic driver there is no modification of behavior. So we adapt, and climate change adaptation is a whole other sector I have spent a considerable effort on figuring out as the publisher of Climate Change Business Journal. But more important is the change in the energy business, which I believe will only come about if we put a price on carbon emissions, ideally with a global carbon tax.

Suzanne Shelton is principal at Shelton Group PR, the natural products industry's leading boutique public relations outfit.

About the Author(s)

You May Also Like